10 Best Copy Trading Platforms in 2024

Automated trade duplication is a method that has changed many individuals’ approaches to the market. This technique allows anyone to mechanically imitate the transactions made by others, gaining access to sophisticated techniques and data.

The strategy continues to be popular in 2024, with a wide range of services meeting the demands of newcomers as well as professionals. This article examines several well-known copy trading services and software, emphasising each one’s features.

Key Takeaways

- There are plenty of platforms offering trade replication services, each with unique features, benefits, and methods for mitigating risk.

- Such services provide simple access to expert strategies and prospects for diversification.

- Understanding the regulation, functionality, and reliability of different options is vital to picking the best fit.

The Essence of The Method

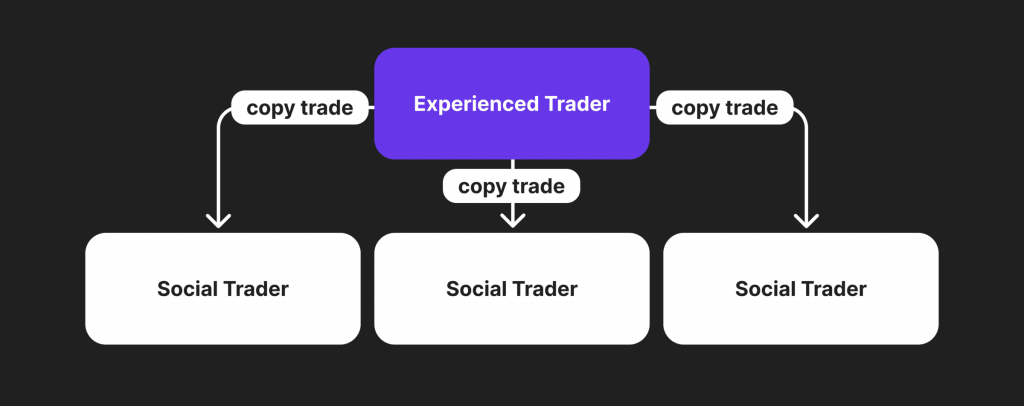

Copy trading streamlines traders by letting users observe and mimic the behaviours and actions of professionals. Copiers can review several lead traders, evaluate their records, and choose the ones to fit their objectives.

Basing your own behaviour on the methods of successful traders is the main advantage of this type of system, when copiers not only profit from the expertise of others, but also learn from the best. This can benefit those new to trading or who need more time to do thorough research.

Another pro is the simplicity. Copiers don’t need to be skilled in analysis or tactics. Users can choose a lead trader based on their track record, allowing the trading platform to duplicate their trades automatically.

However, there are also, of course, some risks. Copiers are dependent on the performance of the lead traders they follow, meaning they have little influence over their behaviour. Copiers could also lose money if a lead trader makes terrible trades. In addition, copiers should be aware of the risks because, like other forms of trading, there is a chance for losses in any market, especially during major price fluctuations or corrections.

Who Benefits from Copy Trading?

Duplicating trades can benefit a wide range of market participants, including traders and brokers. We will discuss the specifics in the sections below.

The Necessity For Traders

Copy trading offers an excellent chance for people, particularly those new to the world of trading, to overcome obstacles like lack of expertise and time limits. By repeating the way of veteran investors, traders can obtain expert tactics and insights, which could boost their trading performance. Also, copy trading helps traders distribute risk over various assets and methods, offering diversification benefits.

In addition, traders can use trade-following to make passive earnings. By selecting which system to follow, anyone may earn a portion of the profits from their trades without having to handle their positions actively.

The Necessity For Brokers

That said, copy trading is also quite crucial to brokers. They can become more credible and sought-after by offering such services. Brokers can also grow their clientele and revenue streams by drawing in customers searching for passive investing alternatives.

Adding position following to their offerings can also give brokers and exchanges a competitive advantage. Offering advanced and practical trading options like this one can set brokers apart and draw in a more extensive clientele.

So, trade replication helps both traders and brokerages. Since, there are multiple softwares available, choosing the right one can be a difficult choice. When looking for the best copy trading platform, one should observe social trade copier functionality and the efficiency of the software.

Fast Fact

The practice of trade duplication initially became known in the mid-2000s. Through sharing their methods, traders allowed others to use their established records to repeat their success.

Top 10 Copy Trading Platforms

We can probably say that copy trading has become a game-changer. As the need for these platforms keeps rising, we include the top 10 providers to help you make the best decision. These platforms address the various demands of traders and brokers by providing multiple features, such as smooth user experiences and robust risk management tools.

Each platform provides different trading fees, trading history access, and tools like mirror trading, which lets users mimic the moves of experienced players.

1. B2Copy

B2Copy is a software revolutionising the industry with its innovative capabilities and setting flexibility. The crypto and forex social trading platform allows brokers to take advantage of the expanding demand for trade replication worldwide by providing a simplified 3-in-1 solution for PAMM and MAM accounts and copy trading. Because of B2Copy’s user-friendly design, brokers can easily incorporate these well-liked trading strategies into their services, growing their clientele and offering more options.

B2Copy provides several features that are intended to improve user experience and revenue. The platform is an excellent option for investors and master traders due to its customisation and adaptability. Skilled traders may showcase their trading prowess and attract new investors by creating engaging profiles with B2Copy. With just one click, investors may follow someone else on the platform, resulting in a flawless trading experience.

Additionally, investors may trade confidently, knowing their risks are managed thanks to B2Copy’s risk management measures, including maximum drawdown limits and cash loss restrictions. All things considered, B2Copy is revolutionising copy trading by giving brokers an effective instrument to expand their clientele and boost earnings.

2. eToro

With no copy trading software fee, customers of eToro, regarded as one of the nicest platforms, can begin replicating transactions with as little as $200. Users who copy on eToro can also benefit from a 0% commission on stock trades.

3. Vantage Markets

A reputable trade-following site, Vantage Markets has an easy-to-use mobile app that lets customers follow other traders for as little as $50. Users may effortlessly diversify their risk and choose from various signal suppliers using Vantage Markets.

4. AvaTrade

AvaTrade provides AvaSocial, a user-friendly program that supports the best social trading platform software. It offers no trading commissions and a minimum deposit requirement of $100. It supports various asset types, such as options, FX, shares, and other instruments.

5. Trade Nation

TradeCopier is an excellent copy trading tool offered by Trade Nation. It allows users to select the trader they like to replicate based on their criteria. After that, users can unwind and leave the trade to the professionals.

6. Pepperstone

Pepperstone provides CFD and forex copy trading software via DupliTrade, Meta Trader Signals, and Signal Start. You can enjoy several crypto-supported platforms in 2024, such as TradingView and cTrader, and quickly access and duplicate trading methods by linking your Pepperstone account.

7. Skilling

Skilling Copy provides users with access to over 400 trading strategies via the cTrader web application. Users can select a strategy to copy and set up parameters like stop loss and size, all within a growing trade copier community.

8. Gate.io

Gate.io is a well-liked platform for trade replication that offers access to over 1700 coins and is well-known for its liquidity. Users can quickly locate and duplicate effective techniques, as over 57,000 traders have made their tactics available for public access.

9. MetaTrader 4 & 5

Two of the most popular platforms in the forex world, MetaTrader 4 and 5, include a smooth integration of the MetaTrader copy trading platform. With the backing of several hundred brokers, it provides a native language known as MQL5. Users have access to multiple trading bots and systems that are available for use within MQL5.

For a small monthly subscription, MQL5 also offers a straightforward way to mimic other existing possibilities. The copying solution from MetaTrader provides traders with an entire solution for their investing needs, thanks to its wide range of trading tools.

10. cTrader

Online brokers can be contacted through the third-party cTrader copy trading platform. cTrader offers equity-to-equity plans, which means that copied positions are proportional to the amount deposited, even though it does not allow equities in traders’ portfolios. Commodities and currencies are among the supported asset classes.

Conclusion

We’ve discussed a type of trading that can bring a variety of benefits. Traders can gain hands-on experience and might have the possibility of passive income, while brokers and exchanges have the opportunity to enhance offerings, draw customers, and remain competitive against rivals.

Remember, that copy trading is not without its risks. This activity can befall traders by putting up with large losses from a single copied dealer, as well as the possibility of losing money when following an unprofitable system. Be sure to do your research and select a reliable trade duplication platform or broker before diving into this journey.