Grayscale Chart: How Will the Recent Court Ruling Affect Coinbase and MicroStrategy?

A recent court ruling that gave a major victory to the cryptocurrency industry sent shares of Coinbase Global and MicroStrategy soaring higher, leading many investors to believe they had found two stock market winners. However, a closer look reveals that the situation may be more complicated. What works out in MicroStrategy’s favour may not be the same for Coinbase Global.

On Tuesday, a federal court ruled that the Securities and Exchange Commission (SEC) acted unlawfully in stopping crypto asset manager Grayscale from converting its Bitcoin Trust into an exchange-traded fund. The new ETF would have tracked the spot price of the digital currency.

Bitcoin Holdings of Grayscale Chart:

The news of a potential Bitcoin ETF approval has been welcomed by the cryptocurrency world as it paves the way for more mainstream investments in digital assets. Major financial companies such as BlackRock have already applied for their own version of such funds.

Following the news, the price of Bitcoin saw a significant jump, leading to an increase in shares for crypto broker Coinbase and tech firm MicroStrategy. Founded and chaired by Bitcoin enthusiast Michael Saylor, MicroStrategy is renowned for its substantial holdings of the digital currency.

According to Mark Palmer, an analyst at Berenberg, the change in MicroStrategy stock — which was up 11% on Tuesday but down almost 3% on Wednesday — makes the most sense. Berenberg recommends MicroStrategy as Buy, with a price target of $510; Wednesday’s opening price was $375.10.

As of July’s end, MicroStrategy owned approximately 152,800 Bitcoin tokens valued at $4.2 billion according to the present prices – a value that constitutes much of the company’s total market capitalization of $5.2 billion.

While a spot Bitcoin ETF may be an attractive alternative to MicroStrategy for investors wanting Bitcoin exposure, it would still be beneficial to the firm in the long run. Palmer believes that approving a spot ETF will be beneficial for Bitcoin and, thus, MicroStrategy. He contends that anything positive for Bitcoin will inevitably cause an increase in the share price of MicroStrategy.

Coinbase is a different tale. Berenberg assesses the company as Hold with a price target of $39, with the stock opening at $83.56 after gaining 15% on Tuesday.

Investors viewed the Grayscale ruling as a severe defeat for the regulator, which is also in a legal battle against Coinbase. This caused stocks to rise sharply afterwards. However, according to Palmer, it would be misguided to draw any conclusions about the SEC case against Coinbase based on the Grayscale ruling.

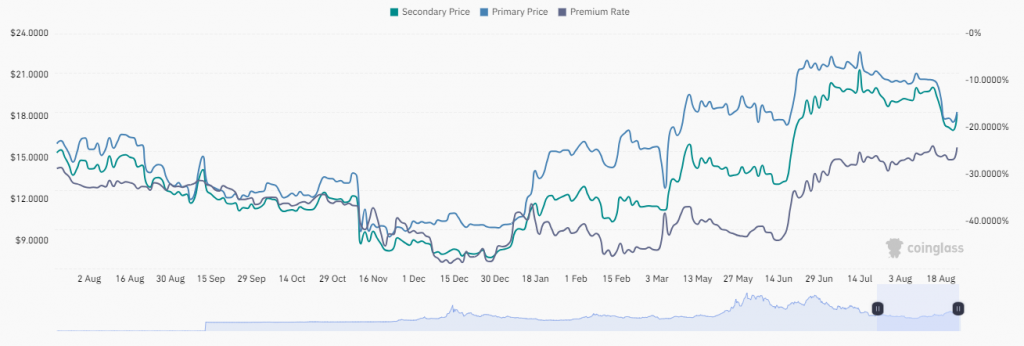

Premiums on Investments in BTC of Grayscale Chart:

Coinbase, for one, sees the verdict favourably. On Tuesday, the company’s chief legal officer, Paul Grewal, said that the decision shows the SEC should reconsider how it approaches enforcement and the consideration of crypto-related applications.

The share price of Coinbase has risen more than 50% since BlackRock submitted an application, primarily due to the anticipation that it would be the custodian for Bitcoin spot ETFs. However, according to Palmer from Berenberg, this excitement may be exaggerated as the added revenue is unlikely to make a major impact on the company. Instead, Coinbase could generate profit through other avenues, such as selling market data to ETF providers.

Palmer believes that Coinbase itself may be a risk factor for the approval of spot Bitcoin ETFs and could serve as part of the SEC’s arguments for rejecting applications. Coinbase is currently in dispute with the SEC over whether certain digital assets it processes should be classified as securities subject to regulation by the agency.

In response, Coinbase’s chief legal officer, Grewal, released a statement that the spot exchange-traded products will bring a lot of potential to investors. According to him, Coinbase serves as a custodian and is actively working on partnerships with other exchanges in order to comply with regulations.

According to Palmer, the SEC might be able to craft alternative arguments in the future, which could lead to a different outcome than before. It is still possible for the SEC to put forth successful claims in order to reject spot Bitcoin ETF applications in the future.

It would be detrimental for Bitcoin, MicroStrategy and Coinbase if this were the case.