How to Develop AI Agent for Crypto Trading

The crypto market never stops, and keeping up with its constant shifts is a real challenge. This is where an AI trading agent enters the picture – a sophisticated tool designed to monitor market dynamics, identify potential patterns, and execute trades with greater speed than manual methods typically allow.

If you’re a developer, a data fan, or just a crypto investor looking for an edge, building your own AI crypto bots might sound appealing. But how do you actually get started? This guide will walk you through the key steps to develop AI agent.

Key Takeaways:

- AI crypto robots can improve their performance over time by adapting to market conditions.

- Managing intelligent risks and maintaining model currency are essential for continual success.

- Price, sentiment, and on-chain data can be combined into a single multi-dimensional dataset.

What is an AI Trading Agent?

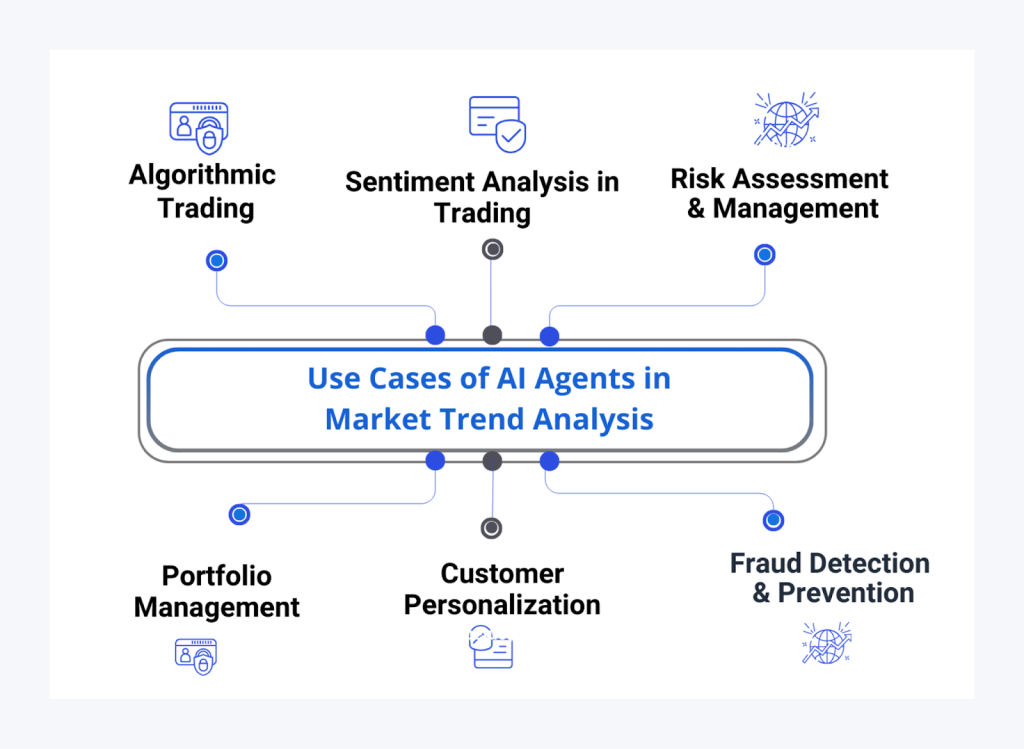

An AI trading agent represents a software system leveraging artificial intelligence techniques (machine learning, deep learning, or reinforcement learning) to interpret market data, formulate trading decisions, and automate trade execution. These systems are specifically developed for operation within financial markets, particularly the cryptocurrency space, with minimal or no direct human intervention required for their ongoing processes.

These intelligent agents process extensive historical and current market information. The objective is to uncover subtle patterns, emerging trends, or market anomalies that could foreshadow price movements. This dataset might encompass everything from price and volume fluctuations, order book depth, and social media sentiment shifts to broader macroeconomic indicators. Utilizing learning algorithms, the agent then interprets this data to project potential cryptocurrency behaviors.

Unlike conventional algorithmic trading systems that rigidly follow pre-set rules, AI agents possess the capacity for ongoing learning and adaptation. A reinforcement learning-based agent, for instance, can run through simulated trading scenarios under various market conditions, adjust its approach based on the resulting profit or loss feedback, and thereby progressively refine its strategies. This adaptability is particularly valuable in the highly volatile and often unpredictable domain of crypto trading.

How AI Enhances the Agent?

What truly transforms a standard trading bot into an intelligent, adaptive agent is its AI core. Traditional automated systems typically operate on fixed, pre-programmed rules – for example, a simple instruction like “buy if the price crosses above a moving average.”

AI-powered agents, however, move beyond such static logic. They can learn from new data, adjust their strategies over time, and make decisions by recognizing complex patterns that often elude basic technical indicators alone.

Pattern Recognition and Prediction

AI, using machine learning and deep learning specifically, is exceedingly good at finding patterns in large and often disorderly datasets.

In the crypto market, where prices rarely behave in a straightforward, predictable manner, AI models excel at identifying subtle signals in historical data. Signals may hint at potential trend reversals, momentum shifts, or support and resistance levels.

In this context, for example, a long short-term memory (LSTM) neural network can analyse sequences of candlestick data to predict short-term price movements. Over time, an AI agent could anticipate future trends better than traditional, rule-based systems.

Adaptive Learning and Strategy Evolution

AI’s strength is in being adaptable. Markets change quickly, and most strategies become outdated very fast. Reinforcement learning (RL) enables an agent to learn by trial and error. The agent is simulated on different trading scenarios and given feedback in the form of either rewards or penalties.

The self-improvement process helps the agent better navigate the field of decision-making, avoid repeating mistakes, and gradually upgrade the effectiveness of their strategies. The strategy adapts to changing market conditions, making the system more resilient and dynamic compared to traditional, static trading algorithms.

Multi-Factor Decision-Making

Contrary to standard crypto trading bots, which are hinged on technical indicators, AI agents can manage various data types at the same time. This means that real-time prices, news reports, macroeconomic data, and sentiment analyses of social media from, say, Twitter or Reddit are all processed and weighed by AI agents.

Language NLP (Natural Language Processing) empowers the agent to interpret emotion conveyed by the text-based sources, therefore making more intelligent choices. For instance, a surge in positive emotion about a cryptocurrency such as Ethereum could entice the agent to start a trade, taking into account the chart and the wider picture.

Risk Management and Optimisation

AI does more than just improve trade entry and exit. It can enhance your risk management, too. That’s because AI models can predict potential drawdowns. They can evaluate volatility in the market and make dynamic adjustments to position sizes to fit with your risk tolerance.

Similar to genetic algorithms or Monte Carlo simulations, portfolio optimization strategies let you put your capital to good use across different assets. This eliminates exposure to unnecessary risks and protects the long-term capital. Your trading strategy will be both aggressive and safe when it comes to that.

Anomaly Detection and Market Awareness

Cryptocurrency markets are filled with surprises. Suddenly, there could be flash crashes or significant transfers between wallets. There could also be an outage or a breach in security. AI models taught with unsupervised learning methods, such as autoencoders or clustering, can find anomalies in the data in real time.

The anomalies could signify market manipulation or unanticipated risks. The trading agent can then act quickly, pausing trades, reducing exposure, or taking advantage of something rare before the broader market does.

Automation at Scale

AI makes crypto trading strategies scalable in ways that manual methods cannot. Once a model is trained, it can be run across multiple crypto exchanges and timeframes at the same time.

Over time, an agent can also specialize, maybe trying to trade different assets in very different ways. It might decide to be aggressive when trading Bitcoin, but very conservative when trading smaller cryptocurrencies. This approach increases the performance of the agent and makes trading in a wide variety of assets possible around the clock.

How to Develop AI Agent for Crypto Trading?

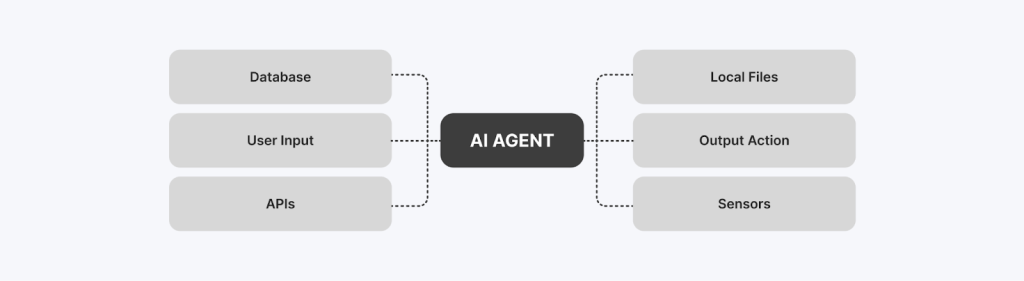

An AI trading agent isn’t one model or a script. It’s a modular system with interconnected components. Each part is responsible for transforming raw data into trading decisions and making their execution possible in real-time.

A summary of the major elements and their functions is as follows:

Data Ingestion Module

This will be the foundation for the AI trading agent, which will be responsible for gathering historical and up-to-date market data from a wide variety of sources. This will involve exchange APIs such as Binance and Coinbase Pro, data aggregators like CryptoCompare and CoinGecko, and sentiment-rich platforms such as Reddit, Twitter, and news feeds.

Several sophisticated systems can pull in data from explorers and follow what is happening on-chain, including price information (OHLCV), order book depth, social sentiment indicators, wallet movements, and technical metrics.

To ensure performance and reliability, the ingestion module must be low-latency and capable of handling API rate limits, retries, and downtimes without disrupting operations.

Data Preprocessing and Feature Engineering

Raw market data is often noisy, incomplete, or inconsistent. This component cleans and transforms it into meaningful features that can be fed into machine learning models. It handles tasks such as filling in missing values, smoothing noise, and applying normalisation techniques like Z-score or Min-Max scaling.

It also involves generating technical indicators (like RSI or MACD), encoding time-based features (trading session or weekday), and extracting sentiment scores using natural language processing.

Sometimes, dimensionality reduction techniques like PCA are used to improve performance. High-quality feature engineering is critical — well-structured input data often determines how well the AI model performs.

AI/ML Prediction Engine

At the agent’s heart lies the prediction engine — the intelligence layer responsible for generating trading signals or market forecasts. The design may utilise supervised learning models to predict price direction, deep learning architectures like LSTMs or CNNs to analyse complex patterns, or reinforcement learning agents that learn from trial and error.

In many cases, ensemble methods combine multiple models to improve robustness. This module interprets the features the preprocessing layer provides and outputs either a directional signal (buy/sell/hold) or probability-based forecasts to guide the agent’s next action.

Strategy Logic and Signal Filter

The raw output of the AI model needs interpretation and refinement. This is where the strategy logic comes in. It processes the model’s predictions in the context of predefined rules and filters.

For instance, the system might only enter a trade if a predicted probability of price increase exceeds a certain threshold and aligns with a low RSI value. It can also reduce position sizes during volatile periods or avoid trades under certain market conditions altogether.

This layer ensures that the AI’s decisions are data-driven and aligned with a broader, risk-aware trading strategy.

Trade Execution Engine

Once a trade signal is confirmed, this engine handles the interaction with crypto exchanges. It connects securely via API, places market or limit orders, monitors execution status, and adjusts orders based on real-time conditions. It calculates position sizes based on the trader’s risk model and ensures that fees, slippage, and order failures are accounted for.

A good execution engine also includes fallback mechanisms — such as retrying or cancelling orders if a network issue or API error occurs — to ensure reliability even during fast-moving market conditions.

Risk Management System

A crucial part of the agent, this system ensures capital preservation. It enforces limits such as stop-loss and take-profit thresholds, caps position sizes (e.g., no more than 2% of total capital per trade), and monitors drawdowns on a daily or rolling basis. It may also dynamically adjust leverage or exposure based on volatility.

Even if the AI generates accurate predictions, this module safeguards against catastrophic losses and helps the agent survive under extreme market conditions.

Portfolio and Capital Allocation Module

In more advanced systems, the agent doesn’t just manage a single trade — it manages an entire portfolio.

This module might adjust holdings between major cryptocurrencies like BTC and ETH, steer more capital towards strategies demonstrating stronger recent performance, or modify allocations in response to evolving market trends or perceived risk signals. The overall aim is to cultivate a well-structured and diversified portfolio that dynamically adapts to changing conditions over time.

Monitoring, Logging, and Analytics Dashboard

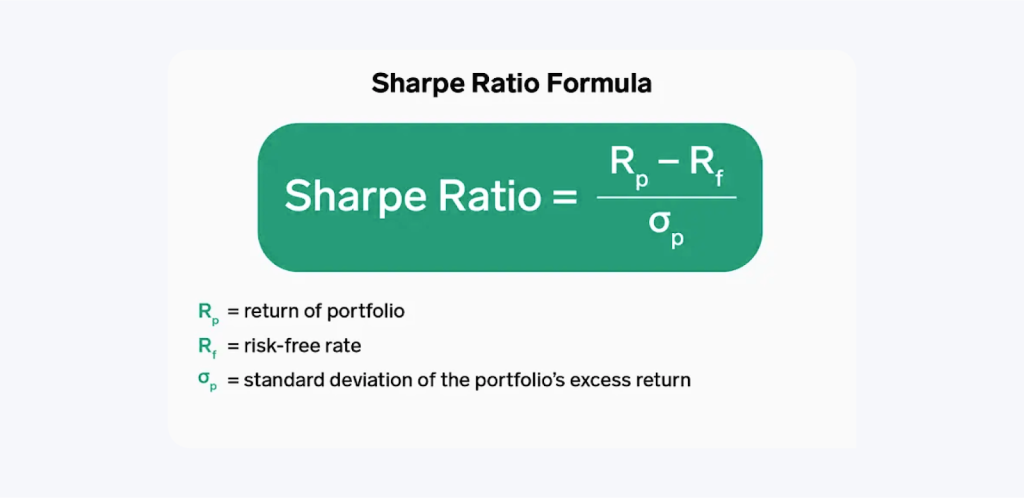

The agent must include a comprehensive monitoring system to track performance and diagnose issues. This component logs trades, actions, errors, and system behavior in real-time. Key performance analytics to monitor often include win rates, profit/loss calculations, Sharpe ratios, and drawdown figures.

Visual dashboards, perhaps created using tools like Grafana, Streamlit, or Plotly, offer an at-a-glance overview of these metrics. Automated alerts, delivered via email, Telegram, or other channels, can notify developers or traders when anomalies or predefined thresholds are met. Proper monitoring ensures transparency and allows developers or traders to make informed adjustments.

Model Training and Update Pipeline

AI models degrade over time as market conditions evolve. This component keeps the system up to date by automating the retraining process. It gathers new data on a regular schedule (daily, weekly, or monthly), evaluates model performance, and either updates the model weights or triggers a rollback if the updated model underperforms. This continuous learning loop helps prevent model drift and keeps the agent competitive in a fast-changing market.

Security and Infrastructure Layer

Given that crypto trading entails handling real funds and sensitive credentials, robust security measures are non-negotiable. This foundational layer ensures that API keys are properly encrypted and securely managed (perhaps using environment variables or specialized vaults), access to critical components is tightly restricted, and all data flows are protected.

Key infrastructure elements often include containerization technologies like Docker or cloud-based deployment solutions, which facilitate reliable operation and scalability across different environments. Implementing failover mechanisms is also crucial, ensuring the system can recover automatically from unexpected crashes or network disruptions.

Conclusion

The fusion of AI and crypto is transforming how we trade, turning bots into intelligent agents capable of adapting, learning, and making real-time decisions. While developing an AI trading agent requires time, skill, and a thoughtful approach to risk, the payoff can be significant.

As markets transform, those equipped with smarter tools will always be ahead. Now that you know how the engine works, it’s time to build your own.

FAQ:

What is an AI crypto bot?

An AI crypto bot is an automated trading system that uses machine learning or deep learning to make and execute real-time trading decisions.

Do I need coding skills to build a crypto trading bot?

Yes, basic to intermediate coding (especially in Python) is usually required to build and customise an AI agent effectively.

What’s the best AI model for crypto trading?

There’s no one-size-fits-all, but LSTMs for time-series forecasting or reinforcement learning models like PPO are popular choices.

Can I make passive income with an AI trading agent?

Potentially, yes — but only with proper strategy design, risk controls, and regular maintenance. It’s not a “set it and forget it” solution.