How to Launch an ICO in 2024 – Detailed Guide

Fundraising for any startup or business idea is the most important and quite difficult stage in any activity. One of the most popular fundraising methods in the blockchain and cryptocurrency industry is an Initial Coin Offering (ICO), allowing startups and entrepreneurs to raise capital by issuing their own ICO tokens.

With the rapid growth of DeFi and blockchain technology, it is a unique possibility to bring innovative ICO projects to life while engaging a global investor base.

However, launching an ICO successfully requires careful planning, legal compliance, and a solid understanding of the process’s technical and business aspects. If you’re wondering how to launch an ICO, this comprehensive guide will walk you through the essential steps, key requirements, and considerations for a successful ICO launch.

Key Takeaways:

- Establishing a successful ICO requires careful planning, legal compliance, and a solid own ICO project with real-world utility.

- A well-orchestrated marketing strategy that engages the crypto community through social media, forums, and listing websites is essential to drive demand for your token.

- The cost of launching an ICO varies greatly depending on the own ICO platform, marketing, and legal fees. However, the investment is worth it if done right.

What is an ICO Campaign?

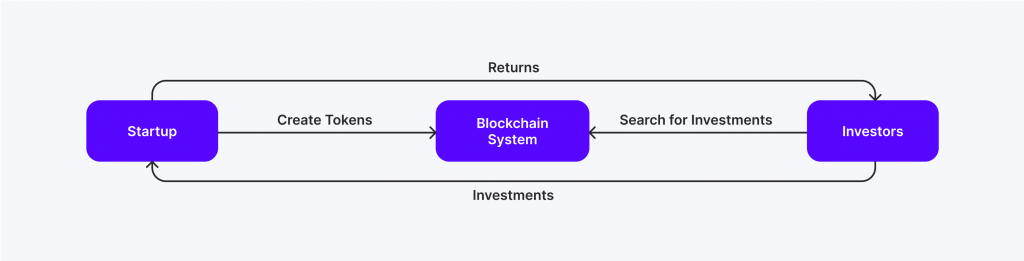

An ICO is a crowdfunding technique where companies in the blockchain industry sell digital tokens to investors in exchange for other cryptocurrencies or fiat money. These tokens often represent a stake in the company or access to its products and services.

In an ICO, a company outlines its vision and details how the funds will be used, typically through an ICO whitepaper. Investors buy into the project early, hoping that the value of the tokens will rise as the project develops and gains traction.

ICOs are often compared to initial public offerings (IPOs) in traditional finance, but instead of shares in a company, investors receive tokens.

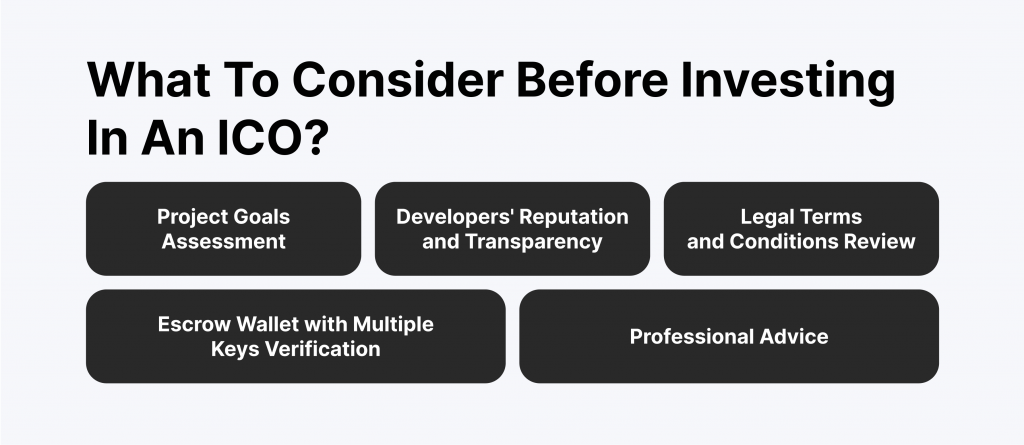

The flexibility and ease of access have made ICOs a popular fundraising tool. Still, they come with risks, such as regulatory challenges and potential fraud, making careful planning and legal compliance critical to success.

Fast Fact:

Of all-time’s greatest ICOs is Ethereum from 2014. The sale of their Ether tokens generated a massive sum of around $18 million as they promoted the new and innovative idea behind smart contracts.

Why Launch an ICO Campaign?

Launching Initial Coin Offerings offers several advantages, especially for startups and blockchain projects looking to raise funds. Here are some key reasons to launch an ICO:

Access to Global Funding

ICOs allow companies to tap into a global investor base. Unlike regular fundraising methods that may be restricted to certain regions or accredited investors, ICOs enable anyone with internet access and cryptocurrency to participate, broadening the potential pool of investors.

Lower Barriers to Entry

Unlike long-established funding methods like venture capital or IPOs, ICOs generally have fewer regulations and financial requirements. This makes it easier for smaller startups and projects to raise funds without needing extensive resources or legal frameworks.

Community Building and Early Support

An ICO allows you to create a community around your project early on. Investors become stakeholders, providing both funding and advocacy for your project, which can drive adoption and increase the project’s visibility.

Decentralization and Innovation

ICOs align with the ethos of decentralization, which is central to blockchain technology. Launching an ICO allows projects to maintain more control over their operations and governance without relying on centralized financial institutions.

Token Utility

ICOs often create tokens with specific utility within a project’s ecosystem, such as access to services, voting rights, or rewards. This fosters a self-sustaining economy around the project, incentivizing token holders to participate and support its long-term growth.

However, ICOs are not without their challenges. Regulatory landscapes constantly evolve, and competition for investor funds can be fierce. It’s essential to ensure your project offers a compelling solution with a strong value proposition to succeed in the ICO market.

How to Create an ICO Project

Launching an ICO requires a strategic approach. Each phase needs careful planning, from conceptualizing your project to executing the token sale.

Step 1: Develop a Strong Project Idea

Your ICO’s success depends heavily on the value your project provides. Whether it’s decentralized finance, NFTs, or any other blockchain solution, ensure your project has clear, measurable goals.

- Define your mission.

- Research market demand.

- Identify your unique value proposition.

Step 2: Choose the Blockchain Platform

The Ethereum blockchain is a popular choice for many due to its smart contract functionality. If you’re curious about how to launch an ICO on Ethereum, you’ll need to understand Ethereum’s ERC-20 token standard, which makes it easy to develop and issue tokens.

Other blockchain platforms you might consider:

- Binance Smart Chain

- Cardano

- Polkadot

Each ICO platform has its pros and cons regarding scalability, transaction speed, and fees. However, Ethereum remains the most trusted choice due to its large developer community and security.

Step 3: Create Your Cryptocurrency Token

Creating your token is at the heart of the ICO process. ICOs generally issue two types of tokens: utility tokens and security tokens.

- Utility Tokens offer access to your project’s products or services.

- Security Tokens represent investment contracts and are subject to financial regulations.

ICO launch software can streamline token creation by providing ready-to-use solutions. Tools like TokenMint or OpenZeppelin Contracts Wizard allow you to create and deploy your token with minimal coding knowledge.

Step 4: Write a Compelling Whitepaper

Your whitepaper is the blueprint of your project. It outlines your business model, the problem you aim to solve, and how your token fits into the solution. A whitepaper should include:

- Technical details of your project

- Token distribution strategy

- Project roadmap

- Legal considerations

A well-constructed whitepaper builds trust and credibility among potential investors, so take the time to get it right.

Step 5: Develop a Legal Framework

Understanding the legal landscape is crucial for avoiding regulatory hurdles. ICOs face scrutiny from various financial authorities, particularly if you’re issuing security tokens. You’ll need to work with legal professionals who specialize in crypto regulations to ensure your ICO complies with the following:

- AML laws

- SEC regulations (for the U.S.)

- KYC requirements

Step 6: Set Up a Marketing Campaign

Marketing is essential for any successful ICO. Build hype around your project by engaging in pre-sale activities, conducting airdrops, and utilizing social media platforms. You’ll want to highlight the uniqueness of your project to potential investors.

- Utilize social platforms like Reddit, Discord, Twitter, and Telegram.

- Submit your ICO to popular listing sites like CoinMarketCap and ICOBench.

- Engage influencers in the crypto space.

Marketing isn’t just about generating buzz; it’s also about building a community around your project. A well-engaged community can be the backbone of a successful ICO crypto launch.

Step 7: Choose the Best Crypto ICO Launchpad

Selecting the suitable launchpad ensures the smooth execution of your ICO. Top crypto launchpads include:

- Binance Launchpad: One of the largest and most reputable platforms.

- CoinList: Focuses on compliance and a broad user base.

- Polkastarter: Popular for cross-chain decentralized projects.

Each launchpad has specific requirements for projects, so choose one that aligns with your goals and offers sufficient support and exposure.

Step 8: Launch the ICO and Manage the Token Sale

Once all preparations are in place, you’re ready for the actual ICO launch. During the ICO, participants buy your tokens using established cryptocurrencies. Managing the ICO involves:

- Offering multiple payment options like Bitcoin and Ethereum.

- Monitoring the smart contract to ensure security and transparency.

- Communicating with your community regularly to keep them updated.

You should also prepare for the post-launch phase, which includes getting your token listed on exchanges and maintaining communication with your investors.

How Much Does it Cost to Launch an ICO?

The cost to launch an ICO can vary widely depending on the project’s complexity, marketing level, legal compliance, and technical requirements. A significant portion of your budget will go into:

- Smart contract development

- Token Development

- Own ICO Website Development

- Legal compliance

- Marketing and promotions

- Token listing on exchanges

- Security and Audit

Based on these factors, the total cost to launch an ICO can range from $50,000 to $300,000 or even higher for large-scale projects. The final cost will depend on the size, complexity, and scope of the ICO, along with the marketing and legal efforts involved.

Conclusion

Launching an ICO presents a unique opportunity for innovative projects to raise capital and build a strong community. By carefully following the steps outlined in this guide and adhering to best practices, you can increase your chances of a successful new ICO launch. Remember, thorough planning, transparent communication, and a focus on delivering value are essential for long-term success.

FAQs:

Who can launch ICO?

A blockchain startup aiming to develop a new app or service with a cryptocurrency can conduct an ICO to secure funding.

How to build an ICO team?

Dig into your network. ICOs are not easy, and you need innovative, smart, reliable, hard workers and extremely trustworthy people.

How to launch ICO on Ethereum?

Choose a Development Environment, Define a Token Contract, Implement ICO Logic, Set Pricing and Parameters, and Handle Funds Securely.

What was the first ICO?

The first ICO was Mastercoin. It took place on the Bitcoin network. In 2013, the Mastercoin ICO development team aimed to create a Layer-2 protocol on Bitcoin that would enable the issuance of new cryptocurrencies.