Near Protocol Price Prediction: A Roadmap to $10 and Beyond

With its cheap transaction costs, quick speeds, and environmental sustainability, Near Protocol—aka NEAR—stands apart and is, therefore, a desirable investment. This analysis uses technical assessments and market indicators to examine Near Protocol’s price trajectory as it approaches the notable $10 target.

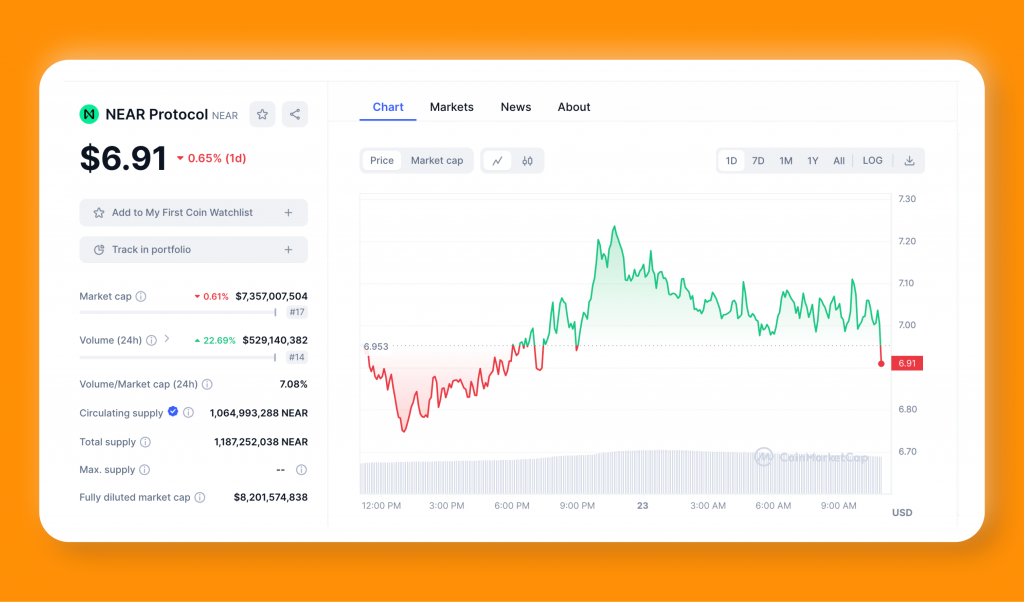

The Near Protocol price chart shows a negative trend with a falling channel pattern.

On the other hand, recent purchasing activity has encouraged a price rebound towards $6, targeting more resistance. The Chart exhibits optimistic signals, indicating that Near might hit or even surpass the $10 threshold based on professional evaluations and significant support and resistance seen in the market.

Current Dynamics and Insights

On its chart, the price of Near Protocol currently displays a descending pattern, signifying a decline. This pattern suggests a possible price breakout.

The price is influenced by the fluctuations in the market and the overall performance of the altcoins. Potential implications are highlighted by analyzing how Near’s price has changed in response to shifts in market sentiment. As a component of the larger cryptocurrency ecosystem, Near Protocol is frequently impacted by these changes.

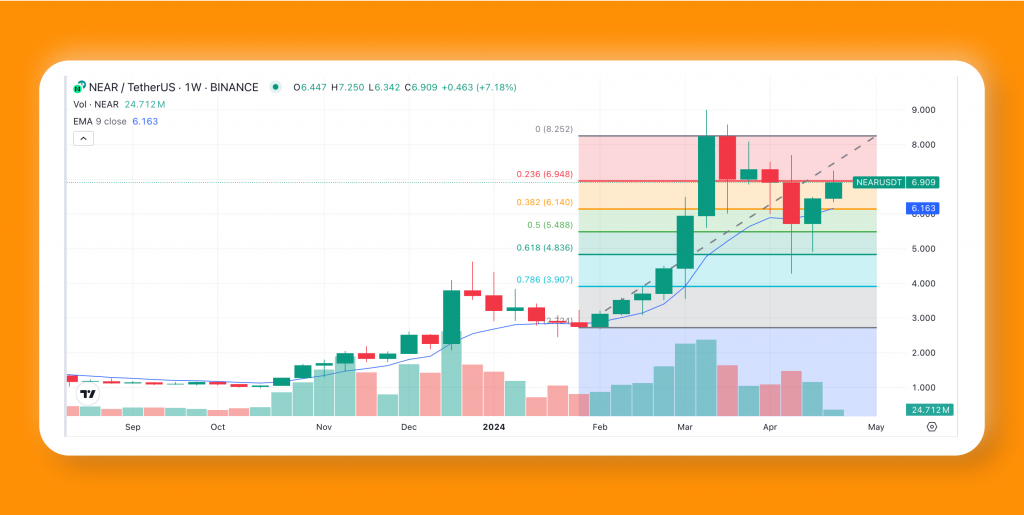

When predicting the price trajectory of NEAR, technical indicators like bullish candles, Fibonacci levels, and EMA crosses are crucial. These indicators offer information about probable near- and long-term price changes for the Near altcoin. Fibonacci levels provide thresholds for resistance and support, purchasing activity is indicated by bullish candles, and momentum shifts are suggested by EMA crosses. Let’s take a closer look at these indicators:

The Roadmap and Price Projections

Phase 3 of Near Protocol’s roadmap includes the use of sharding, one of the technological innovations. This invention improves the transaction processing capacity and scalability of the network. Community-driven initiatives are another essential component of bolstering Near Protocol’s market position.

When examining the Near Protocol pricing projection from 2024 to 2030, new research and professional estimates point to a possible increasing trend for NEAR. This is due to several factors, such as market acceptance, technological advancements, and the general expansion of the crypto industry. These estimates are based in part on the current cost of Near Protocol.

It is anticipated that Near Protocol will be able to break beyond the $10 threshold and reach $14.56 by 2024. By 2030, it is expected to reach lofty peaks shaped by internal advancements and external market forces. From its current perspective, NEAR is one of the altcoins to buy for investors looking for long-term prospects.

Final Thoughts

There are dangers associated with investing in Near Protocol, such as market volatility and potential regulatory issues. These outside variables have the potential to have a big impact near protocol price today and in the future. To manage these uncertainties, careful research is essential.

Near competes with other initiatives for market share. Its unique characteristics and possible technical obstacles may impact its market pricing and pace of adoption. Near Protocol’s future development and market significance will greatly depend on how well it handles these issues.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in cryptocurrencies, including meme coins, carries ingrained risks, and individuals should conduct their own research before making any investment decisions.