What Is A Crypto Market Correction & How Do You Deal With It?

The modern world is automated in many aspects. It doesn’t matter how hard a person tries to change something. There are areas where the system just goes with the flow. The same is true in the cryptosphere, where market corrections are inevitable.

These sudden downturns can be discouraging, but they are a natural part of the market cycle. Understanding what such a correction is and knowing how to respond when it happens is crucial for any crypto investor.

In this article, we discover the concept of market corrections in the cryptosphere and offer practical tips on how to weather the storm and seize opportunities during these challenging times. Whether you’re a seasoned trader or a beginner, buckle up as we explore the ins and outs of crypto market corrections and equip you with the knowledge to overcome this challenging period with confidence.

Key Takeaways:

- Market corrections are temporary declines in cryptocurrency prices after periods of sustained growth, serving as a natural part of the market cycle.

- While corrections are short-term and healthy adjustments, crashes involve sudden and significant price drops, often fueled by panic selling and external factors.

- To thrive in the crypto market, investors must employ sound risk management, strategic trading approaches, and a long-term perspective.

What Is a Market Correction in Crypto?

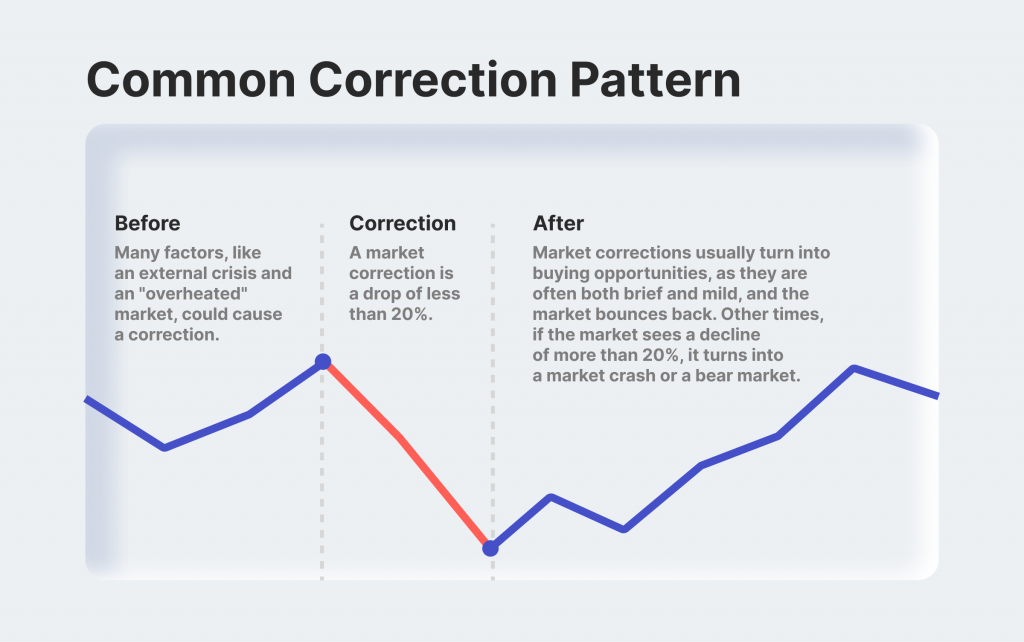

A market correction in crypto refers to significant and temporary falling prices of various cryptocurrencies after a period of sustained growth. During this event, the market experiences a sharp reversal from an uptrend, leading to a decrease in asset prices.

This correction can be caused by various factors, including speculative trading, market sentiment shifts, regulatory or any negative news, macroeconomic events, or simply a natural cooling off after a period of excessive optimism and average price appreciation.

Why Does a Market Correction Happen?

The market corrects for various reasons, and they are a natural and healthy part of any financial market, including the cryptocurrency market. Here are some common reasons why crypto market corrections occur:

- Overvaluation

- Profit-taking

- Fear and Uncertainty

- Market Manipulation

- Trading Algorithms

- Liquidity Squeeze

- Sector Rotation

It’s important to note that crypto market corrections are a natural part of market cycles and are not necessarily a sign of a failing market. Instead, they provide an opportunity for the market to find a balance between supply and demand and allow for healthier, more sustainable growth in the long run.

Fast Fact:

Corrections occur more frequently than crashes. On average, the market declined 10% or more every 1.2 years since 1980, so you could even say corrections are common.

How Long Do Crypto Market Corrections Last?

The duration of a market correction can vary significantly depending on the specific market capitalization, the underlying factors driving the correction, and the overall market sentiment. There is no fixed timeframe for how long a correction will last, as a complex interplay of factors influences market movements.

In general, a market correction in the cryptocurrency market typically lasts for a few days to a few weeks. It is a short-term event aimed at readjusting prices after a period of rapid growth or overvaluation. During this time, prices may experience a moderate decline, often ranging from 10% to 20% from their recent highs.

However, it’s crucial to note that corrections can sometimes be more prolonged, especially in cases where the underlying issues are more significant or where there is increased uncertainty and fear in the market. In some instances, a correction can last for several weeks or even extend to a couple of months.

The term “correction” implies that the market is self-correcting and finding a new equilibrium. Once the market stabilizes and buyers re-enter the market, prices may start to rebound, signaling the end of the correction phase. However, it’s important to keep in mind that corrections are just one part of the larger market cycle, and they can be followed by periods of both consolidation and continued growth.

Market Correction vs. Bear Market: Differences

It’s essential to differentiate between a market correction and a bear market. They are both periods of declining prices in financial markets, including the cryptocurrency market, but they differ in terms of duration, magnitude, and overall market sentiment.

A correction is a short-term phenomenon, typically lasting a few days to a few weeks, and is considered a healthy and necessary process in any market to stabilize prices after rapid gains.

On the other hand, bear markets signify a more prolonged period of declining prices and pessimism, often lasting several months or even years. Here are the main differences between a market correction and a bear market:

- Duration

- The magnitude of the Price Drop

- Market Sentiment

- Purpose

Understanding the differences between these two phases is essential for investor confidence to adjust their strategies and make informed decisions. It’s crucial to understand that market corrections do not necessarily signal the end of a bull market or a crash.

Crypto Market Correction vs. Crash: What’s the Difference?

Both terms describe when prices fall, but there are fundamental differences between them. When the overall crypto market declines, it’s common to see the terms “crash” and “correction” used more or less interchangeably. The two words, however, actually mean different things.

A crash is widely regarded in traditional finance as a drop of over 10% in price over the course of a single day. These are often fueled by impactful, sudden changes in the crypto market that cause panicked investors to exit en masse.

A correction is characterized by a gradual decline where prices drop more than 10% over the course of several days. These usually indicate bull market traders have become exhausted and need time to consolidate and recover. Understanding the nuances between crashes and corrections can help investors make informed decisions.

Best Trading Strategies During Market Correction

During a market correction, the following trading strategies can help you navigate the heightened volatility and potentially capitalize on opportunities:

- Buy the Dip

- Dollar-Cost Averaging

- Focus on Quality

- Employ Stop-Loss Orders

- Avoid Emotional Decisions

- Use Technical Analysis

- Watch Market Sentiment

- Stay Informed

- Practice Risk Management

- Be Patient

Remember that no trading strategy is foolproof, and the cryptocurrency market can be highly unpredictable. Be prepared for unexpected price movements and be willing to adapt your strategies based on market conditions. It’s essential to continually educate yourself, learn from your trading experiences, and be disciplined in your approach to trading during crypto market corrections.

Bitcoin Price Correction in Action

Bitcoin is currently experiencing a significant correction, with its value dropping by more than 10% from its recent high of $73,000. This downturn in the leading cryptocurrency’s price has had a ripple effect across the crypto markets, impacting other major cryptocurrencies such as Ether (ETH), Solana (SOL), and Cardano (ADA), which have also seen notable declines in trading volume.

Despite the recent surge in Bitcoin prices, fueled in part by the introduction of spot Bitcoin ETFs earlier this year, the current market price suggests that ETFs may not be the primary driving force behind cryptocurrency movements. Analysts point out that the recent selling pressure affecting

Bitcoin originated from within the crypto community itself rather than from ETF-related activities. This correction, though significant, is not unexpected given Bitcoin’s rapid ascent from $40,000 to over $73,000.

The correction in Bitcoin prices has also impacted related stocks and companies in the cryptocurrency ecosystem. For instance, MicroStrategy (MSTR) saw its stock drop by as much as 16% before partially recovering following the disclosure of its recent Bitcoin purchases.

Similarly, Bitcoin miners such as Marathon Digital (MARA), Riot Blockchain (RIOT), and Cleanspark (CLSK) experienced declines in their stock prices, signaling potential challenges ahead, especially with the upcoming Bitcoin halving event in April, which could further strain their profitability.

Even crypto trading platforms like Coinbase and Robinhood were not immune to the broader market correction, as their stocks also traded lower amidst the Bitcoin price volatility.

Final Thoughts

Dealing with crypto market corrections in the cryptocurrency space requires knowledge, discipline, and a long-term perspective. Prioritize risk management, stick to your trading plan, and avoid emotional decisions. Corrections are opportunities to buy assets at discounted prices but be aware of the market’s high volatility. Continuous learning and adaptation are essential for success.

Finally, trade with money you can afford to lose and stay patient with your investments. Happy trading and investing!

FAQs

How can I identify market correction?

A market correction is a market decline of more than 10% but less than 20%. A bear market is usually defined as a decline of 20% or greater.

How often does market correction happen?

Just about every year since 1980, the market has experienced a temporary decline of 5% or more. On average, a 5% decline in stock market prices has occurred 4.5 times a year over the same period.

What is a crypto market crash?

Crypto is a volatile asset in general, prone to significant price swings. Some crypto crashes are because of systemic issues within crypto, such as the collapse of FTX in 2022. Other times, macroeconomic factors such as interest rates and inflation can push values down.

What happens if Bitcoin crashes?

If Bitcoin crashes, other cryptocurrencies will likely follow, as Bitcoin’s price action generally heavily reflects market sentiment and pulls other significant cryptocurrencies in the same direction.