What is Paper Trading? — Why New Traders Should Use It

In an industry where the stakes are high, and mistakes are costly, paper trading encourages individuals to try their hand at financial markets without the risk of losing real money. It provides a safe harbor for strategy testing and skill enhancement. Mastering the intricacies of paper trading can significantly elevate a trader’s confidence and competence before they dive into the tumultuous waters of real-world trading.

This article will unpack the meaning of paper trading meaning, detail its benefits, and discuss the common mistakes paper traders should avoid in their journey.

Key Takeaways

- Paper trading is a risk-free process of practicing financial strategies without losing real money.

- Despite its many benefits, paper trading does not account for the emotional pressures of real trading.

- Transitioning from paper to real trading requires emotional endurance, continuous learning, and effective risk management.

What is Paper Trading?

Paper trading, or demo trading, is a simulated trading process that allows individuals to practice buying and selling financial assets without the risk of losing real money. This educational tool benefits both novice and seasoned traders by enabling them to refine strategies and understand market dynamics without financial exposure.

Is paper trading real money? Paper trades imitate real market transactions but utilize “paper money,” meaning no actual capital changes hands.

The core advantage of paper trading lies in its risk-free environment, where trading strategies and decisions can be tested safely. Beginners who are not yet ready to face possible financial losses from actual trading can find this especially beneficial, trying crypto or stock market conditions and experimenting with all that trading platforms can offer: stop-loss, limit orders, and more.

Despite its benefits, paper trading is not without flaws. It does not account for the emotional pressures of actual trading, where real money is at stake.

Where to Paper Trade?

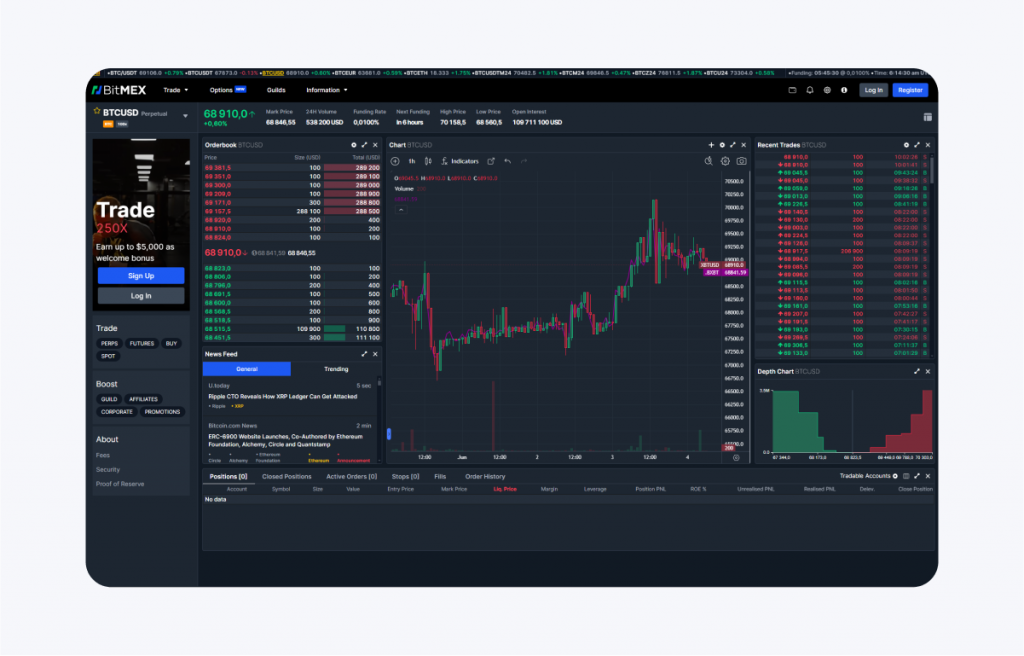

Traders might opt for paper trade simulators that provide a more immersive experience by replicating actual market conditions. These simulators are often available through online brokers, often free of charge, providing a valuable resource for any trader looking to improve their skills.

Today, many different exchanges and brokers offer real-time market conditions with the same trading software used for actual trading. Here are some of the top exchanges and brokers offering demo trading for cryptocurrencies:

- ByBit

- Binance

- eToro

- OKX

- Kraken

Advantages of Paper Trading

Paper trading offers a multitude of advantages, especially for new traders.

Risk-free Environment

When papertrading, traders use virtual money, which means there’s no real capital at stake. The demo environment allows everyone to experiment with various trading strategies and decisions without the fear of losing money.

Strategies Testing

Demo trading is an excellent platform for testing. Paper traders can simulate different market conditions and implement various trading techniques. The use of real-time data and historical backtesting helps users understand how a trading strategy performs under different market scenarios, thereby increasing confidence in the strategy’s viability.

Market Dynamics Understanding

The simulated environment gives traders a clear picture of the actual market reactions to news events, economic changes, and other factors without the risk associated with real trading. Additionally, this practice helps traders familiarise themselves with online trading platforms and various order types, enhancing their overall trading skills and knowledge.

Common Pitfalls of Paper Trading

Despite its many benefits, paper trading is not without pitfalls, with the most significant limitation being that it does not account for the psychological aspect of trading. Here are some common pitfalls to keep in mind:

Overtrading

Overtrading occurs when traders, enticed by the absence of real financial consequences, open too many positions or take excessive risks. The lack of a solid trading plan often leads traders to see opportunities in every market movement, tempting them to ride every price shift.

Excessive trading can result in significant capital loss and poor execution of money management plans when such behaviors are carried over into real trading scenarios. To avoid this, traders should establish and adhere to a rigorous trading and risk management strategy, even in a simulated environment.

Treating It Casually

As already mentioned, the most significant mistake that traders make while paper trading is treating the process too casually. Since real money is not at stake, traders often do not experience the psychological pressures that come with actual trading.

This emotional disconnect can lead to a lack of serious commitment to the trading process, leading to poor habits that can be detrimental when starting real trading. Traders should approach demo trading with the same level of discipline as they would with real trading to ensure consistency and effectiveness in their trading strategies.

Ignoring Psychological Challenges

Ignoring the psychological aspects of trading is a critical mistake many paper traders make. The fear of missing out (FOMO), overconfidence after successful trades, and emotional biases like confirmation bias and loss aversion can all lead to poor decision-making. If not addressed during paper trading, these psychological challenges can carry over into real trading and negatively impact performance.

Traders should focus on developing self-awareness and emotional regulation skills and practice discipline and resilience to deal effectively with psychological challenges. Managing emotions and adhering to trading plans with discipline are part of this process.

Having Unrealistic Expectations

Paper trading does not always reflect the actual market conditions, leading traders to have unrealistic expectations, which often results in disappointment or frustration when moving on to actual trading, where actual profits and losses are at stake.

How to Get Started?

Let’s take a look at the steps involved in getting started with papertrading:

Choose a Platform

The first step in embarking on paper trading is selecting the right platform. Take into account aspects such as the user interface, the variety of available assets, the tools for technical analysis, and the educational resources provided.

Set Up a Paper Trading Account

Visit the platform’s website and follow the procedure to sign up. Ensure you meet any requirements specified by the trading platform, such as age or residency restrictions. Platforms like Interactive ByBit allow you to simulate trading and offer educational content to enhance your trading knowledge.

Learn the Interface and Features

After setting up your account, spend time exploring the platform’s features and tools. Learn how to navigate the interface and access trading instruments, charts, watchlists, and other resources.

Start Trading

Once you are comfortable with the platform, it’s time to start paper trading. Begin by selecting an asset or market of your choice and experiment with different strategies and techniques. Take advantage of the data and tools provided by the platform.

Consistently Evaluate and Improve

But how to paper trade? As with any skill, practice is necessary to improve. Continuously evaluate your performance, pinpoint your weaknesses, and work on refining your strategies. Remember to keep a record of your trades and analyze them to learn from both successes and failures.

Paper vs Real Trading

Engaging in actual trading is a far cry from the risk-free environment of paper trading, given the genuine financial risks involved. This shift can trigger strong emotions like fear and excitement, impacting the decision-making process more significantly than paper trading.

For instance, the fear of losing money can cause a trader to exit a winning trade prematurely or prevent them from executing potentially profitable trades at key reversal points. Conversely, greed may lead traders to hold onto positions too long, hoping for even greater profits,

Mastering emotional control becomes indispensable when transitioning into actual trading. Traders should devise strategies to manage the psychological strains linked to actual financial risks – being mentally prepared for potential losses, as even experienced traders face losing streaks.

Implementing strict risk management strategies, such as the 1% rule, where no more than 1% of trading capital is risked on a single trade, can help maintain emotional equilibrium by mitigating the fear associated with potentially large financial losses.

Guidelines for Paper Trading

To get the most out of demo transactions, you need to follow these practices:

- Trade Realistically: Analyse and trade realistic scenarios, including simulating costs like spreads and commissions. This prepares you for the actual expenses and potential slippage in real trading.

- Adapt and Learn: The market is dynamic, and successful traders continually update their knowledge and strategies. Regularly review your trading plan and adapt to new information and circumstances.

- Manage Your Risks: Use risk management tools and strategies from the start, including setting stop-loss orders and implementing position sizing.

- Be Prepared Emotionally: Ensure you are mentally and emotionally prepared for the highs and lows of trading when moving to real trades. Understand and accept that losses are part of trading, and learn not to let emotions dictate your trading decisions.

Final Thoughts

Demo trading is an invaluable tool for novice traders. It offers a simulation-based platform to develop trading habits, understand market dynamics, and navigate the complexities of financial markets without risking real money. Through this strategy, traders gain not just theoretical knowledge but practical skills for dealing in a real market. However, be mindful that paper trading has its shortcomings and cannot replace the real-life exposure to the market.