What is Tezos Crypto? Embracing Change with a Self-Amending Protocol

In the world of cryptocurrencies, Tezos has emerged as a unique blockchain project that offers several innovative features. One of its standout characteristics is its self-amending protocol, which sets it apart from other blockchain networks. But how does Trezor work? This article explores what Tezos’ self-amending protocol is and what features this blockchain has.

Key Takeaways:

- Tezos is a secure, decentralised blockchain network with a self-amending protocol that allows it to quickly adapt to changes in the market.

- Tezos utilises a consensus mechanism called Liquid Proof of Stake.

- A fundamental aspect of Tezos is its self-amending protocol, which allows the network to grow and adapt over time.

Introduction to Tezos

So, what is Tezos crypto? Tezos is a decentralised blockchain platform that enables the creation and execution of smart contracts. It was initially proposed in 2014 and launched its mainnet in 2018. What sets Tezos apart from other blockchain platforms is its built-in governance mechanism and the ability to upgrade the network seamlessly through a self-amending protocol.

The Tezos blockchain has gained popularity due to its organic and enthusiastic global community, which has enabled the platform to be utilised in various industries such as decentralised finance, art, gaming, and more.

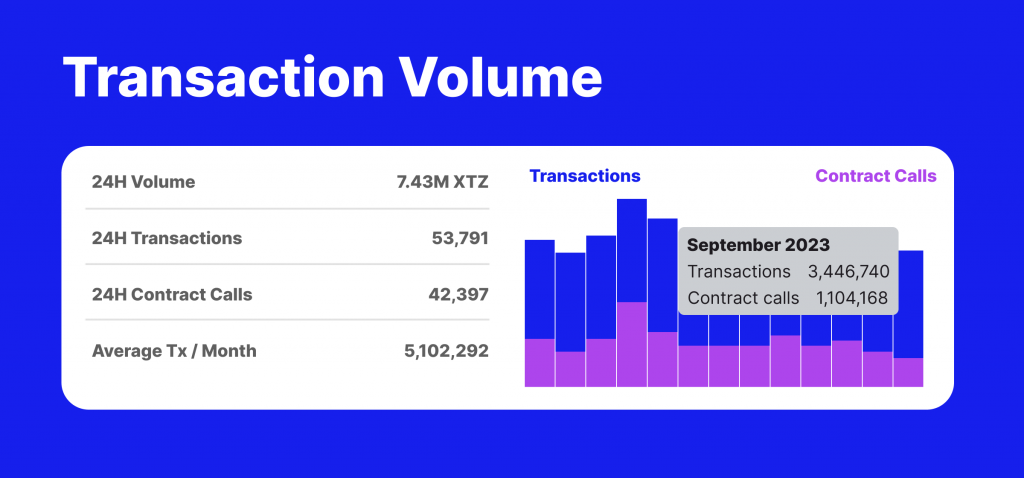

The native token of the Tezos network is called Tez (XTZ). According to CoinMarketCap, the market cap of XTZ is $$625 million as of September 2023.

Understanding the Tezos Blockchain

At its core, Tezos is a blockchain designed to support and run decentralised applications (DApps) and smart contracts. It functions as a distributed ledger, where transactions are recorded and validated by a network of participants known as validators or bakers.

However, unlike traditional blockchain networks, Tezos utilises a specific proof-of-stake (PoS) consensus mechanism called Liquid Proof of Stake (LPoS). To put it simply, instead of relying on energy-intensive mining like Bitcoin, Tezos validators are chosen based on the number of Tez tokens they hold and are willing to “stake” as collateral. Validators are responsible for creating, signing, and publishing new blocks to the Tezos blockchain.

The Tezos blockchain is maintained and upgraded through a unique governance model that allows stakeholders to propose and vote on protocol changes. This on-chain governance mechanism ensures that network upgrades can occur without the need for contentious hard forks, making Tezos highly adaptable and resistant to forks such as the one that led to the creation of Bitcoin Cash.

Tezos LPoS Rules

Let’s explore Tezos Proof of Stake in greater detail.

Tezos utilises a unique PoS consensus mechanism known as Liquid Proof of Stake. In this PoS variant, participants, known as “bakers”, are selected to create and validate new blocks based on the number of Tez tokens they hold and are willing to stake.

To become a baker, an individual or entity must hold a minimum of 6,000 Tez tokens. Through the creation, signing, and publication of new blocks, bakers maintain the security and integrity of the Tezos blockchain. They are also responsible for endorsing blocks created by other bakers.

Fast Fact:

71.15% of the total supply of Tezos is staked, as of September 2023.

If an individual does not have the minimum required number of Tez tokens to become a baker or does not want to set up the necessary infrastructure, they have the option to delegate their tokens to a baker. Delegating tokens allows individuals to contribute to the network’s consensus mechanism and receive rewards based on their stake.

Formal Verification

Tezos places a strong emphasis on security and reliability. It incorporates a formal verification process, which allows developers to mathematically prove the correctness of their smart contracts and protocols. This rigorous approach mitigates the risk of vulnerabilities and enhances the overall security of the Tezos network.

Smart Contracts on Tezos

Smart contracts are another fundamental feature of the Tezos blockchain. They are self-executing contracts with predefined rules and conditions that are automatically enforced when certain conditions are met. Smart contracts enable the development of decentralised applications and facilitate the execution of complex transactions without the need for intermediaries.

Fast Fact:

The most popular network for smart contracts today is Ethereum. It is estimated that there are currently over 44 million smart contracts deployed on the ETH blockchain.

Tezos smart contracts are written in a language called Michelson, created especially for the platform. However, developers can also write smart contracts using higher-level languages such as SmartPy, Ligo, or Archetype, which compile to Michelson.

To execute transactions on the Tezos network, users need to pay a fee in Tez tokens. These fees ensure network integrity and security by incentivizing validators.

Tezos Governance and Self-Amendment

One of the key features that sets Tezos apart from other blockchain platforms is its on-chain governance model. The Tezos protocol allows stakeholders to propose and vote on changes to the protocol, including amendments to fees, consensus algorithms, and other system parameters.

The governance process on Tezos is facilitated through a formalised voting system. Stakeholders have the right to take part in decision-making by either directly voting on proposed changes or delegating their voting power to other stakeholders. This ensures that the network remains decentralised and that decisions are made collectively by the community.

The self-amendment feature of Tezos allows the network to evolve and upgrade smoothly without the need for contentious hard forks. Through on-chain governance, stakeholders can propose and implement changes to the protocol, making Tezos highly adaptable to technological advancements and regulatory requirements.

How Does the Self-Amending Protocol Work?

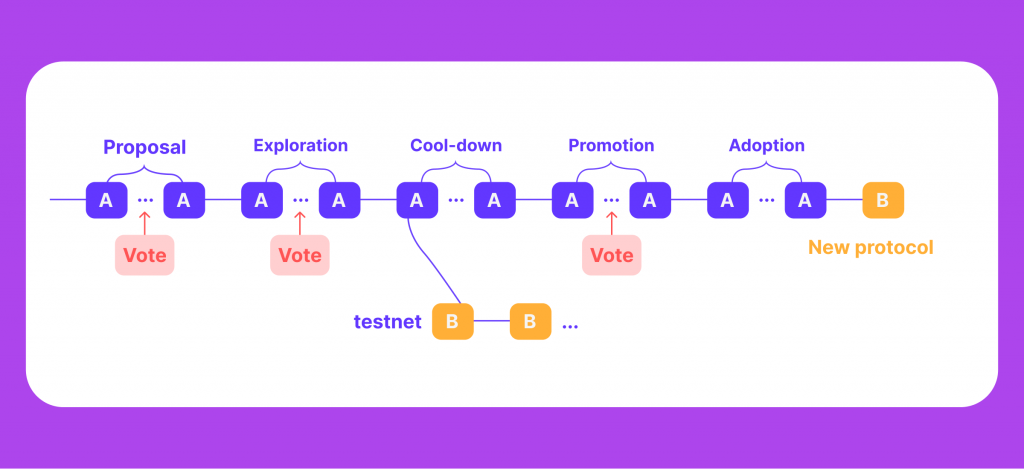

The self-amending protocol is a fundamental aspect of Tezos that enables the network to evolve and adapt over time. Here’s a step-by-step breakdown of how the self-amending process works:

- Proposal – Any participant in the Tezos network can submit a proposal for a protocol upgrade. The proposal is then subjected to a period of discussion and refinement.

- Exploration Vote – After the proposal is refined, it enters the exploration vote phase. During this phase, token holders can cast their votes in favour or against the proposed upgrade. The exploration vote helps gauge the level of support for the proposal within the community.

- Testing Phase (Cooldown) – If the proposal garners sufficient support during the exploration vote, it moves to the testing phase. In this phase, the proposed upgrade is thoroughly tested and audited for potential vulnerabilities and bugs.

- Promotion Vote – After successful testing, the proposal enters the promotion vote phase. Token holders once again have the opportunity to vote on whether to adopt the proposed upgrade. If the proposal receives enough votes in favour, it is activated on the Tezos network.

- Protocol Upgrade – Once activated, the new protocol upgrade is seamlessly integrated into the Tezos network. The self-amending process ensures that the upgrade does not require a hard fork, minimising disruption to the network and maintaining the continuity of the blockchain.

The self-amending protocol of Tezos allows for decentralised decision-making and ensures that the network can adapt to new technological conditions and address any potential security concerns.

An Overview of Tezos’s Self-Amendments

Tezos, a blockchain platform, has demonstrated an impressive ability to self-amend itself multiple times a year. This flexibility and adaptability have allowed Tezos to continuously evolve and incorporate new features and improvements.

One notable example of this self-amendment capability is the February 2021 Edo upgrade. This upgrade introduced protocol-level support for both fungible and non-fungible tokens, expanding Tezos’ utility and enabling a wider range of digital assets to be built on the platform. Additionally, the Edo upgrade also introduced Z-cache’s sapling, which further enhanced privacy and scalability on the Tezos network.

Another significant self-amendment occurred in April 2022 with the Ithaca upgrade. This upgrade brought about deterministic finality by replacing the consensus algorithm from Nakamoto consensus to a Tendermint-like BFT consensus. By hot swapping the consensus algorithm, Tezos achieved greater security and efficiency in its blockchain network.

The April 2023 Mumbai upgrade introduced yet another milestone for Tezos. This upgrade introduced Smart Optimistic Roll-Ups (SORU), which are enshrined rollups directly supported by the L1 protocol. SORU enables anyone to deploy fully permissionless WebAssembly (WASM) rollups, providing a more efficient and scalable way to process transactions on Tezos.

These upgrades not only introduce new features but also address any potential limitations or challenges faced by the platform. By embracing self-amendment, Tezos offers its users a secure, efficient, and versatile ecosystem for building decentralised applications and digital assets.

Tezos Use Cases

But what is Tezos used for? Tezos is being widely adopted in various industries and has been used for a wide range of applications. Some of the prominent use cases of Tezos include:

- Decentralised Finance (DeFi): Tezos provides a platform for the development of applications to lend and borrow money, as well as to exchange tokens on a decentralised platform.

- Tokenization of Assets: Tezos enables the tokenization of real-world assets such as real estate, art, and jewellery, allowing for easier transfer of ownership and greater liquidity.

- Non-Fungible Tokens (NFTs): The Tezos blockchain has seen significant activity in the NFT space, with major brands like Manchester United, Ubisoft, Redbull Racing, and McLaren utilising the platform for NFT-based initiatives.

Fast Fact:

According to the platform’s own tracker, the current daily transaction number of Tezos is 53,791, which is much less than daily transactions of Ethereum, which totaled 990,751 on the same day.

- Governance and Voting Systems: The self-amendment and on-chain governance features of Tezos make it suitable for implementing transparent and decentralised governance and voting systems.

- Supply Chain and Traceability: Tezos can be used to create transparent and tamper-proof supply chain solutions, ensuring the authenticity and traceability of products.

The Pros and Cons of Tezos

So, how does Tezos compare to other blockchains and what are its strengths and weaknesses?

Tezos certainly offers several advantages over other blockchain platforms. Its self-amending protocol allows for seamless upgrades and ensures the adaptability of the network. Unlike Bitcoin, which requires contentious hard forks for protocol upgrades, Tezos can smoothly upgrade and adapt to changing needs without disrupting the system. Additionally, the use of a PoS consensus mechanism makes Tezos energy-efficient and scalable.

However, Tezos also has some drawbacks. The complexity of its governance model can make decision-making processes slower compared to platforms with more centralised governance. Additionally, the relatively smaller developer community and ecosystem compared to platforms like Ethereum may limit the availability of tools and resources for building decentralised applications.

Storing and Investing in Tezos

If you are interested in storing or investing in Tezos, there are various options available. XTZ tokens can be stored in software wallets like Trust Wallet, which provide secure storage and easy access to your funds. Hardware wallets like Ledger and Trezor also support Tezos storage through third-party software.

In addition to storing Tezos, you can also participate in staking and earn rewards by delegating your XTZ tokens to bakers. Platforms like Binance offer staking services where you can stake your tokens and earn passive income.

Conclusion

Tezos offers a range of features that set it apart in the world of cryptocurrencies. Its self-amending protocol enables seamless upgrades and ensures the network can evolve over time without requiring disruptive hard forks. With its emphasis on security, inclusivity, and formal verification, Tezos provides a robust platform for decentralised applications and smart contract development. By empowering token holders with governance rights, Tezos fosters a community-driven approach to decision-making.

As the blockchain industry continues to evolve, Tezos stands as a testament to the importance of adaptability and innovation in creating a sustainable and secure decentralised ecosystem.

FAQs

Self-amendment: what does it mean?

Self-amendment means that Tezos is able to upgrade its blockchain without having to undergo hard forks. This allows it to quickly adapt to changing market conditions, while still maintaining the security of the platform.

Exactly what is a blockchain fork?

A blockchain fork is a type of software update that changes the rules governing the blockchain, resulting in two versions of the blockchain existing simultaneously. The new version and the old version will continue to exist in parallel, with each version of the blockchain having its own set of transactions. The new version may also be incompatible with the old version, meaning that users on the old version may not be able to access the new version.

Why does Tezos stand out from the competition?

Tezos stands out from its competitors because it uses a self-amending protocol, meaning that it is able to automatically upgrade itself without undergoing a hard fork. This allows users to remain on the Tezos blockchain without having to switch to a new version.

What does the address of a Tezos wallet look like?

The address of a Tezos wallet looks like a string of numbers and letters, beginning with the number “tz”. This address is used to receive and send Tezos, and it cannot be changed or edited.