Why and How to Backtest on TradingView

Everyone involved in trading wants to be sure their trading approach is reliable and profitable. This is especially true for those who have just started their trading journey. Backtesting trading strategies on a platform like TradingView can be a perfect option for ensuring the success of the trading.

Backtesting is a crucial step in trading strategy development, allowing the estimation of past trading performance using historical data. TradingView is a favored medium for backtesting, analyzing, and executing trading strategies. It offers an assortment of tools and features for technical analysis, backtesting, and strategy development, making it a powerful and versatile tool for traders.

This article explores the backtesting concept and provides guidelines on how to backtest on TradingView.

Key Takeaways

- TradingView is a platform for real-time interactive charts and technical analysis tools.

- Backtesting helps in identifying the strengths and weaknesses of your strategy and fine-tuning its parameters.

- To succeed in backtesting, use a wide timeframe and avoid overfitting.

What Is TradingView?

TradingView is a web-based platform that provides traders with real-time interactive charts and technical analysis tools. It offers an intuitive interface, various indicators, and drawing tools for detailed market analysis.

The platform is suitable for beginners and has mobile applications for iOS and Android devices, allowing users to access their charts anytime and anywhere. It offers a free version with limited functionality and subscription plans for additional features and real-time data.

TradingView offers an intuitive interface and powerful backtesting tools, allowing traders to test their strategies on past market data.

The platform offers various strategies for backtesting, including the following:

- Technical analysis: analyzing past price movements to identify future opportunities.

- Momentum strategies: they focus on stocks with strong price movements, using technical indicators like candlesticks and momentum oscillators.

- Fundamental analysis: this method analyzes company financials to identify undervalued stocks.

- Portfolio strategies: the analysis involves creating a portfolio of stocks based on specific criteria and monitoring their performance over time.

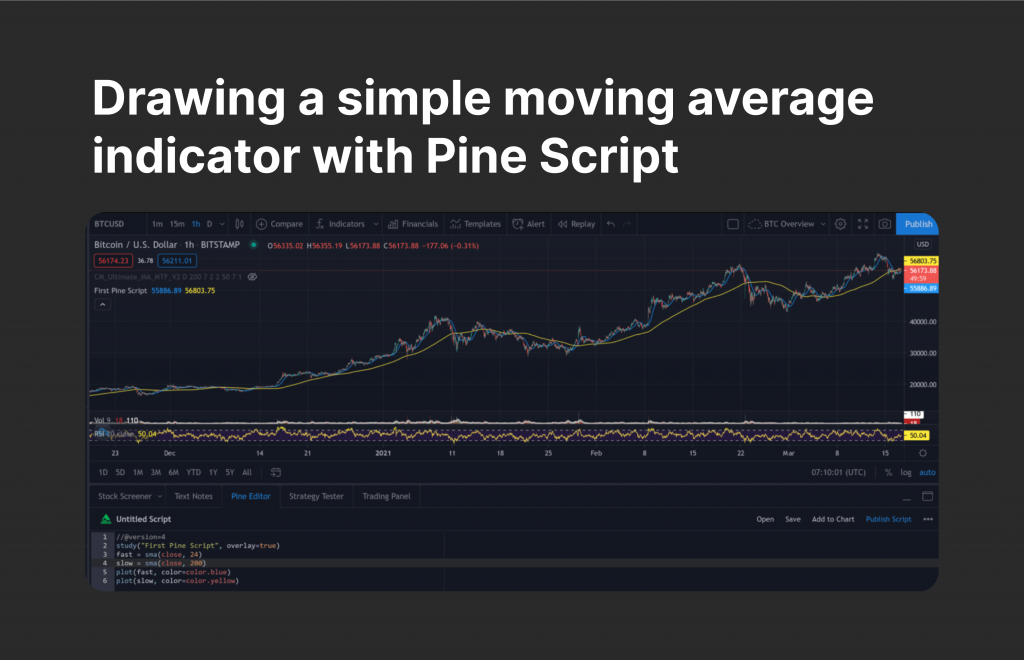

Tradingview has its own scripting language, Pine Script, which offers numerous functions and is more accessible than high-level programming languages. It allows for backtesting custom strategies and creating TradingView indicators, strategies, and libraries, simplifying idea conception and implementation.

Pine Script provides extensive documentation, allowing for testing on any asset and timeframe, saving screen time, and improving data analysis.

Why Backtest Your Tradng Strategies

Backtesting is crucial in trading as it assesses the effectiveness of strategies by simulating past trades. It helps identify potential flaws, optimize entry and exit points, and determine risk management measures. It also provides valuable insights into a strategy’s profitability, drawdowns, and overall performance, enabling traders to make informed decisions and refine their approaches.

Backtesting a trading strategy is crucial for traders because it offers multiple benefits. Thus, it helps determine if a strategy has a positive expectancy, needs improvement, or correlates with other strategies.

It also provides a risk-free strategy assessment, allowing for a complete evaluation within an afternoon. While demo accounts are often used, backtest results are preferable as they don’t replicate live trading.

This methodology allows traders to quickly understand their strategy by going through 30 to 50 trades within a few hours, helping them understand price behavior. Moreover, it boosts confidence by providing a clear understanding of the strategy’s performance, which is crucial for live trading. Understanding the average win rate, holding time, and frequent losing streaks can boost confidence and help overcome drawdowns with a strong mindset.

How to Perform Backtesting: A Step-by-Step Guide

Here is a detailed guide on how to use TradingView for backtesting.

1. Picking the Market and the Time Frame

Select a market, such as FX, stocks, or cryptocurrencies, and a suitable timeframe. The choice should be based on the trading strategy being tested, such as a day trading strategy.

2. Setting Up the Chart

Set up a candlestick chart to visualize price history and backtest the market. Add indicators, drawing tools, and chart overlays. Enable the strategy tester feature to show long-term price history beyond the chart’s visibility.

3. Adding Strategy Logic

TradingView offers two options for adding strategy rules and logic: coding a custom strategy using Pine Script, which allows for full customization of entries, exits, and risk management but requires programming knowledge, and using the Visual Strategy Builder, which provides a no-code way to specify strategy logic, is simpler but more limited than coding a custom strategy.

4. Running the Backtest

To run a backtest, define your strategy logic through code or the Visual Builder. Select a historical timeframe and click “play” to execute simulated trades. Start with a 1-year backtest and gradually increase the timeframe to assess performance over longer periods.

5. Analysing the Results

Analyzing results from various angles is crucial for gauging strategy validity. TradingView offers comprehensive analytics to evaluate strategy performance, including a trade list, portfolio stats, charts, etc. It allows users to view trade details, filter by profitability, visualize equity curves, and optimize parameters for a more profitable strategy.

6. Refining and Re-Testing

Common refinement techniques include adjusting entry and exit rules, adjusting position sizing, optimizing parameters, and eliminating poor trades. Re-run the backtest and analyze until you achieve a satisfactory historical performance for your strategy.

7. Forward Testing and Implementing

The final step involves further testing and going live. This step includes forward testing on recent price data, paper trading using virtual funds, and going live with actual capital.

Tips on Successful Backtesting

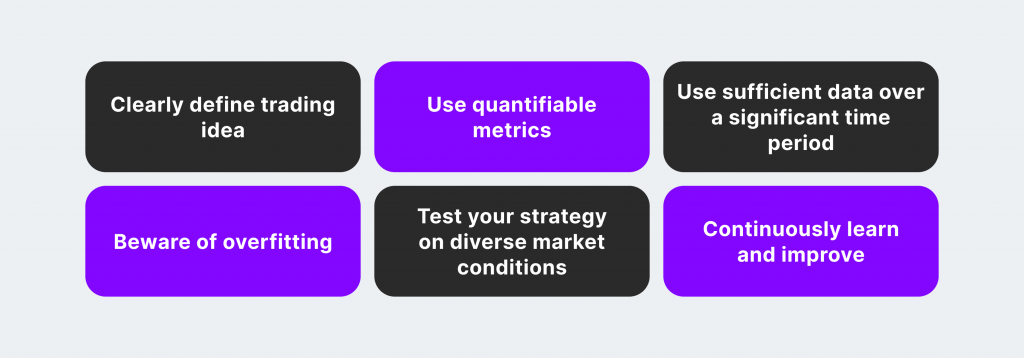

Common mistakes in backtesting include insufficient data that can lead to skewed results, over-optimism, leading to poor future performance, and neglecting costs.

To succeed, define your trading idea clearly and use quantifiable metrics like Sharpe ratio, maximum drawdown, or win rate.

To effectively backtest trading strategies on TradingView, use sufficient data over a significant period, aiming for at least 100 trades and 10+ years of data. Also, be realistic and include fees like slippage, commissions, and spreads to account for potential costs.

Beware of overfitting, where a strategy is too closely tailored to past data, making it less likely to succeed with new data. To avoid bias, account for transaction costs, test your strategy on diverse market conditions and continuously learn and improve.

Test portfolio strategies, evaluate risk and money management stats, and conduct real-world validation before real capital deployment using forward testing, paper trading, and live trading to observe the real-time performance of your strategy.

To ensure the power of your backtesting strategy, it’s crucial to regularly review and update it, trade cautiously, and manage risk effectively.

Final Takeaways

TradingView is a versatile platform that offers traders a range of tools for technical analysis, allowing for both manual backtesting that stimulates trading on historical data and automatic option that involves the strategy tester to generate performance reports. It is an excellent choice for beginners interested in trading and learning how to backtest on TradingView to develop their plans.

TradingView backtesting is a valuable tool for real-life trading simulation. It has been tested on nearly 5,000 ideas and has proven to be effective in real-life trading.