Crypto Tax Calculator: The 7 Best Tools to Simplify Your Crypto Taxes in 2025

Digital asset trading has surged in popularity in 2024 and 2025, but with it comes the responsibility of tax compliance. Many crypto investors struggle to determine their tax liabilities, especially when dealing with multiple transactions, exchanges, and jurisdictions.

If you’ve ever found yourself staring at a spreadsheet filled with transaction data, wondering how to make sense of capital gains, staking rewards, and taxable events—don’t worry. Crypto tax calculators are designed to do the heavy lifting for you, turning a complex process into a streamlined, stress-free experience.

In this guide, we will explore how crypto tax calculators work, their benefits, and the seven best crypto tax calculators available today.

Key Takeaways

- Many crypto investors use tax software to automate the process and avoid penalties.

- Different countries have different crypto tax rates, making accurate tax calculations crucial.

- Some tax-friendly regions offer tax-free crypto benefits, but compliance is still necessary when cashing out profits.

What is a Crypto Tax Calculator?

A crypto tax calculator is a user-friendly software that helps you determine the taxes you owe on your cryptocurrency activities. It connects to your crypto exchanges and wallets, automatically tracks your transactions, calculates gains or losses, and generates reports that align with your country’s tax regulations.

These tools generate tax reports that are formatted for regulatory compliance, making it easier to file your taxes—or hand everything over to your crypto tax accountant.

How Does a Crypto Tax Calculator Work?

Unlike traditional stock markets, crypto operates 24/7 across multiple exchanges, with various forms of income—trading, staking, mining, airdrops, and even play-to-earn gaming. Tax authorities worldwide classify and tax these transactions differently, so manual calculations are a nightmare.

That’s where crypto tax software takes over:

1. Importing Transactions

Crypto tax calculators sync with your exchanges, wallets, and blockchain addresses to fetch your entire transaction history. No more endless copy-pasting from CSV files—these tools automate the process, ensuring nothing gets left behind.

2. Categorizing Transactions

Not all crypto activity is taxed the same way. The software automatically identifies taxable and non-taxable transactions, sorting them into categories like:

- Capital gains (from selling, trading, or swapping assets)

- Income (staking, mining, airdrops, yield farming)

- Gifts and donations (which may have different tax implications)

This classification is crucial, as different types of transactions are taxed differently depending on your jurisdiction.

3. Applying Tax Rules

Crypto tax laws vary widely from country to country. In the U.S., for example, the IRS treats crypto as property, meaning selling or swapping tokens triggers capital gains tax. In Germany, holding Bitcoin for over a year makes it tax-free crypto.

A crypto tax calculator automatically applies the correct crypto tax rate based on your location, saving you the headache of sifting through tax codes.

- Generating Tax Reports

Once all transactions are categorized and tax rules applied, the software generates detailed tax reports that are ready for submission to tax authorities like the IRS, ATO, or CRA. These reports include:

- Capital gains and losses calculations

- Income statements for staking, mining, and airdrops

- Transaction history for audit purposes

Some tools even provide reports in formats compatible with TurboTax, H&R Block, and other tax filing software, making the filing process seamless.

5. Filing Taxes

At this stage, you can either file taxes yourself using the generated reports or export them directly to tax-filing platforms. Many crypto tax calculators also integrate with crypto tax accountants, allowing professionals to review and submit your return on your behalf.

Fast Fact

In many countries, each crypto-to-crypto trade is considered a taxable event, not just when you convert to fiat currency.

7 Best Crypto Tax Calculators in 2025

Which crypto tax software is worth your time? Here’s a deep dive into the seven best crypto tax calculators this year:

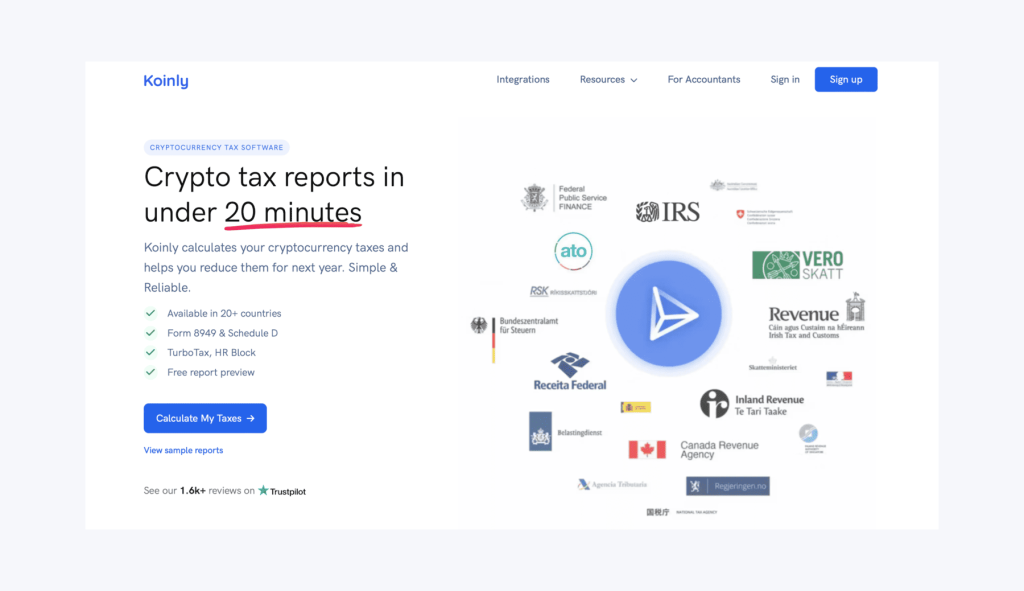

1. Koinly

Koinly has built a reputation as one of the easiest-to-use crypto tax solutions on the market. If you’re new to crypto tax reporting, this is one of the best places to start.

With support for over 400 exchanges, 170+ blockchains, and DeFi and NFT transactions, Koinly automatically tracks your trading history, calculates your capital gains and losses, and generates tax reports that comply with regulators like the IRS, HMRC, and ATO.

Koinly also includes tax-loss harvesting—a feature that helps traders reduce taxable gains by offsetting them with losses. Plus, it integrates with major tax software like TurboTax and Xero, making tax filing seamless.

Best for: Beginners and long-term investors who want an easy-to-use interface.

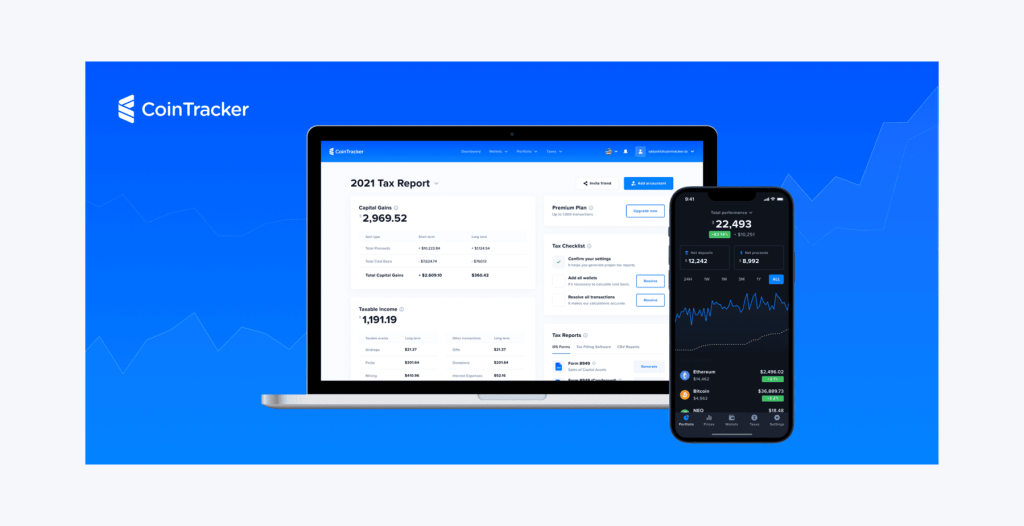

2. CoinTracker

CoinTracker is more than just crypto tax software—it doubles as a portfolio tracker. If you want a tool that not only handles your tax calculations but also provides real-time insights into your holdings, CoinTracker is a strong choice.

It supports over 300 exchanges and wallets, making it easy to sync your trading history. The tax features include capital gains calculations, FIFO/LIFO methods, and automated tax reports that align with various regulatory frameworks.

One of CoinTracker’s standout features is real-time tracking—you don’t have to wait until tax season to know where you stand.

Best for: Active traders who want both tax reporting and live portfolio tracking in one platform.

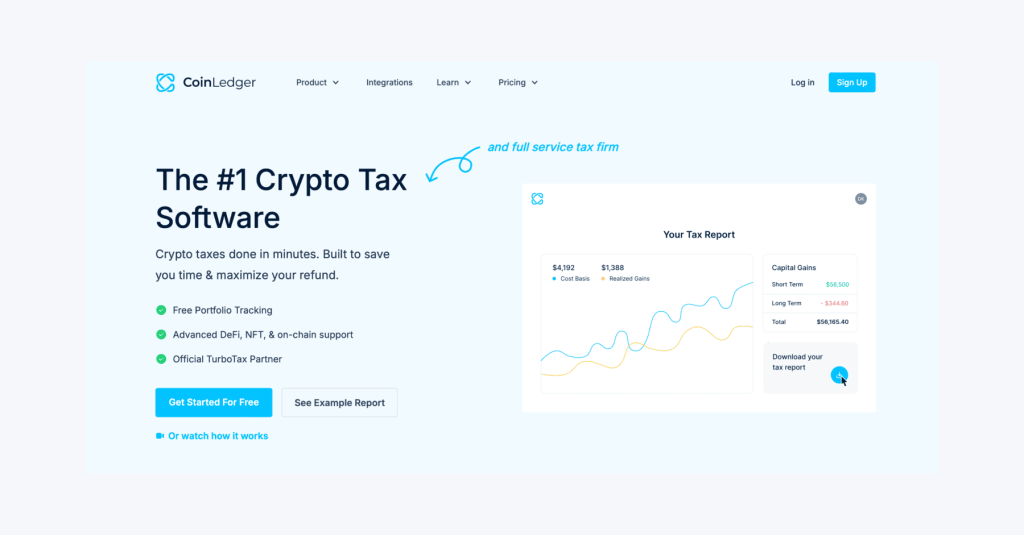

3. CoinLedger

Formerly known as CryptoTrader.Tax, CoinLedger is a cost-effective solution for those looking for crypto tax software without breaking the bank.

It supports 100+ exchanges and wallets, offers seamless TurboTax integration, and provides a step-by-step guide for users who might not be familiar with tax filing.

One of its best features is import flexibility. Users can manually upload CSV files if they prefer not to sync their accounts directly, which is a great option for privacy-conscious traders.

Best for: Cost-conscious traders looking for an affordable, beginner-friendly option.

4. Accointing by Blockpit

Accointing is more than just a crypto tax calculator—it’s a powerful investment insights tool that helps users track their trading performance.

The software supports various exchanges and wallets, enabling users to assess their gains and losses over time. One of its greatest strengths is tax-loss harvesting, which automatically recommends methods to reduce tax liabilities by strategically disposing of underperforming assets.

Accointing also offers a free plan that provides basic tax reporting, making it an attractive option for casual traders who want to test the waters before committing to a paid plan.

Best for: Investors looking for tax-saving strategies alongside tax reporting.

5. ZenLedger

If you’re deep into DeFi, NFTs, and staking, ZenLedger is one of the best crypto tax solutions available.

Unlike other platforms that struggle with complex DeFi transactions, ZenLedger is designed to effortlessly manage liquidity pools, yield farming, NFT trades, and staking rewards. It supports over 100 DeFi protocols and major blockchains, such as Ethereum, Solana, and Avalanche.

For U.S. users, ZenLedger also integrates with TurboTax, H&R Block, and other tax filing services, making it one of the most IRS-friendly options.

Best for: DeFi and NFT traders who need specialized tax support.

6. TaxBit

TaxBit isn’t just for individual traders—it’s designed with institutions, enterprises, and crypto exchanges in mind.

Backed by major firms like PayPal, TaxBit provides automated tax calculations, real-time tax tracking, and audit-friendly reports that comply with government regulations.

One of its standout features is TaxBit Network, which allows users to access free tax forms from participating exchanges. This means you may not even need to pay for crypto tax software if your exchange partners with TaxBit.

Best for: Large-scale traders and institutions looking for IRS-approved tax reporting.

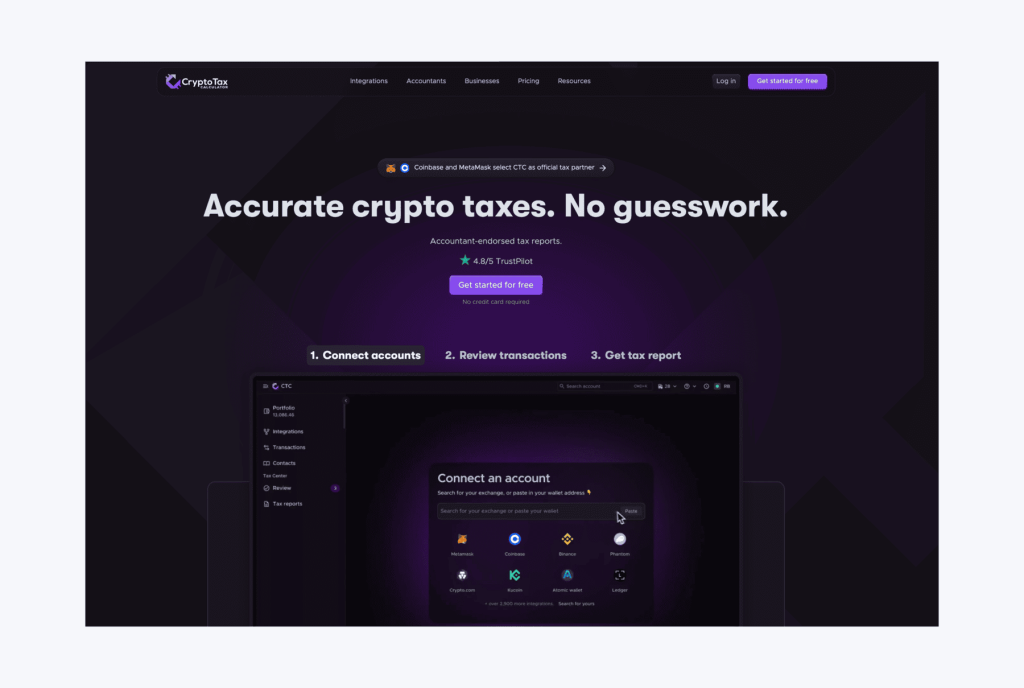

7. CryptoTaxCalculator

For users who need advanced tax calculations, CryptoTaxCalculator is one of the most powerful options on the market.

It supports a wide range of DeFi and NFT transactions, handling staking rewards, lending, borrowing, and wrapped tokens with precision. If you’re an advanced trader, this tool ensures nothing gets lost in translation when calculating tax liabilities.

Additionally, CryptoTaxCalculator is one of the few platforms that allows API access, making it a great choice for developers and professionals who want to customize their tax reporting process.

Best for: Advanced traders, developers, and users dealing with complex DeFi transactions.

Fast Fact

In the U.S., if you fail to report your crypto gains, the IRS can charge you with tax evasion—leading to fines, interest, or even criminal charges in extreme cases.

Why Do You Need a Crypto Tax Calculator?

Managing cryptocurrency taxes manually can be overwhelming, especially if you have multiple trades across different platforms. Here’s why every crypto investor and businesses need a tax calculator:

Crypto Taxes Are More Complicated Than You Think

Unlike traditional stock trading, where your broker provides you with a tax report, crypto is a different beast. Each transaction—whether it’s a trade, a swap, an airdrop, or even using crypto to buy coffee—could be considered a taxable event. The more transactions you have, the harder it becomes to manually track what’s taxable and what’s not.

A crypto tax calculator does this automatically. It pulls in your transaction history from multiple exchanges, classifies each event, and applies the right tax rules based on your country’s regulations.

Saves Time and Effort

If you’ve completed 500 transactions on Binance, Coinbase, and several DeFi platforms the previous year, manually sorting through them, categorizing them, and applying various tax rates could take hours or even days.

Crypto tax software handles all of this in minutes. It syncs with your accounts, compiles the data, and generates reports that are formatted for tax filing.

Avoid Costly Mistakes

Misreporting your Bitcoin taxes—whether due to miscalculations or missing transactions—can trigger an audit or penalties. Tax authorities like the IRS, HMRC, and ATO are cracking down on crypto tax evasion, and errors on your tax return could lead to hefty fines.

Crypto tax calculators minimize the risk of mistakes by ensuring all taxable events are properly accounted for, reducing the likelihood of compliance issues.

Stay Compliant With Local Tax Laws

Crypto tax regulations vary by country and change frequently. Some jurisdictions tax crypto as capital gains, while others consider it regular income. Some countries, like Portugal and the UAE, offer tax-free crypto incentives, while others impose strict reporting requirements.

A crypto tax calculator keeps track of these changes and applies the correct tax treatment to your transactions. This ensures you’re always compliant, no matter where you live or how regulations evolve.

Integrates With Exchanges and Wallets

One of the biggest challenges for crypto investors is tracking transactions across multiple platforms. Most traders don’t use just one exchange—many have wallets, DeFi accounts, and even hardware wallets.

A crypto tax calculator connects directly to these platforms, automatically pulling in transaction data. This removes the need for manual data entry and significantly reduces errors.

Final Thoughts

Crypto taxation is complex, but a crypto tax calculator can make it hassle-free. By automating data collection, categorizing transactions, and generating accurate reports, these tools help crypto investors stay compliant and avoid costly mistakes.

Whether you’re a casual trader, a DeFi degen, or a long-term HODLer, using the best crypto tax software can save you time, reduce stress, and keep you in good standing with tax authorities.

FAQ

Do you have to report crypto under $600?

Yes, you must report all crypto transactions, regardless of the amount. However, transactions under $600 may not trigger a tax liability, depending on your country’s tax laws.

How much tax will I pay on my crypto?

The capital gains tax on crypto depends on your country and how long you hold the asset. In the U.S., short-term gains are taxed at your regular income tax rate, while long-term gains range from 0% to 20%.

Will the IRS know if I don’t report my crypto?

Yes. Many crypto exchanges report user transactions to the IRS. Failing to report your crypto gains can result in penalties and audits.

How much crypto can I cash out without paying taxes?

There is no set limit for tax-free crypto cash-outs. However, tax liabilities depend on factors such as your income, holding period, and local tax laws.