CoinGecko vs CoinMarketCap: Which Crypto Tracker Should You Use?

It is widely known that we live in the age of information technologies, and in such an active environment of cryptocurrency trading, having access to reliable and accurate market data is crucial for making informed investment decisions.

Two of the most prominent platforms in the crypto tracking space are CoinGecko and CoinMarketCap. While both offer valuable insights into the crypto market, understanding key differences can help you choose the one that best suits your needs.

Key Takeaways:

- CoinGecko and CoinMarketCap are leading platforms in cryptocurrency tracking, each offering unique features and insights into the market cap.

- While CoinMarketCap provides extensive data focusing on market capitalisation and trading volume, CoinGecko offers a broader range of information, including developer activity and community engagement metrics.

- Choosing between the two platforms depends on several factors and traders’ specific requirements and preferences.

What Is CoinMarketCap?

CoinMarketCap is a popular website that provides comprehensive data and information about various cryptocurrencies and digital assets. It was founded in 2013 and has become one of the go-to sources for cryptocurrency enthusiasts, traders, investors, and researchers.

Here are some of the pros and cons of CoinMarketCap:

Advantages

Comprehensive Data – CoinMarketCap offers extensive data on different cryptocurrencies, including market capitalisation, trading volume, price charts, historical data, circulating supply, etc. This wealth of information helps users make informed decisions when trading or investing in crypto.

Market Analysis – The platform provides market data analysis, trends, and insights, helping users stay updated on the latest developments and trends in the cryptocurrency space.

User-Friendly Interface – CoinMarketCap has a user-friendly interface that makes it easy for beginners and experienced users to navigate and find the information they need.

API Access – CoinMarketCap offers API access, allowing developers to integrate cryptocurrency data into their own applications, websites, or trading bots.

Mobile App – CoinMarketCap has a mobile app available for iOS and Android devices, providing users access to cryptocurrency data on the go.

Disadvantages

Lack of Regulation – The cryptocurrency market is largely unregulated, and CoinMarketCap does not verify the accuracy of the information provided by projects or exchanges listed on its platform. This lack of regulation can lead to issues such as market manipulation or inaccurate data.

Market Manipulation Concerns – There have been concerns about market manipulation on CoinMarketCap, particularly regarding the reporting of trading volumes by exchanges. Some exchanges may engage in wash trading or other manipulative tactics to inflate their trading volumes, which can misrepresent the overall market data on the platform.

Limited Information – While CoinMarketCap provides a wealth of data, some users may find certain aspects lacking or incomplete. For example, the platform may not always provide detailed information about the fundamentals or technology behind a particular cryptocurrency.

Dependency on Third-Party Sources – CoinMarketCap relies on data from third-party sources, such as exchanges and blockchain explorers, which may not always be reliable or accurate.

Potential for Misinterpretation – The abundance of data on CoinMarketCap can be overwhelming for newcomers to the cryptocurrency space, and there is a risk of misinterpretation or misunderstanding of the information presented.

Overall, CoinMarketCap serves as a valuable resource for anyone interested in cryptocurrencies. Still, users should exercise caution and conduct their own research before making any investment decisions based on the information provided on the platform.

What Is CoinGecko?

CoinGecko is a cryptocurrency data aggregator platform that provides comprehensive information about various cryptocurrencies, including prices, market capitalisation, trading volume, historical data, developer activity, community engagement, and more.

It aims to be a one-stop solution for users seeking to gather market data and insights. Here are some pros and cons of CoinGecko:

Advantages

Comprehensive Data – CoinGecko offers a wide range of data points and metrics for thousands of cryptocurrencies, allowing users to make informed investment decisions.

User-Friendly Interface – The platform is designed to be intuitive and user-friendly, making it easy for both beginners and experienced traders to access relevant information.

Customisable Watchlists – Users can create customised watchlists for portfolio tracking and monitor the performance of their favourite cryptocurrencies over time.

Community Engagement Metrics – CoinGecko provides metrics related to the community engagement of each cryptocurrency, including social media activity, developer activity, and community size, which can offer insights into the project’s popularity and potential.

Market Analysis Tools – CoinGecko offers various tools and charts for analysis, such as current market price charts, volume analysis, and historical data, helping users to identify trends and patterns in the market.

Disadvantages

Limited Data Accuracy – While CoinGecko strives to provide accurate and up-to-date information, the cryptocurrency market is highly volatile, and data accuracy can sometimes be compromised due to factors such as delays in updating prices or inaccuracies in reporting.

Overwhelming Amount of Information – For beginners, the sheer amount of data and metrics available on CoinGecko can be overwhelming and may require some time to understand and interpret effectively.

Reliance on Third-Party Sources – CoinGecko aggregates data from various sources, including exchanges and blockchain platforms. While this provides a comprehensive view of the market cap, it also means that the platform relies on the accuracy and reliability of these third-party sources.

Lack of Regulation – Like other cryptocurrency-related platforms, CoinGecko operates in a largely unregulated market, which can expose users to risks such as fraud, manipulation, and security breaches.

Overall, CoinGecko is a valuable tool for crypto enthusiasts and investors, providing comprehensive data and insights into the market cap.

Fast Fact

CoinMarketCap is owned by the group in charge of the Binance exchange.

CoinMarketCap vs CoinGecko

Choosing between CoinGecko and CoinMarketCap depends on your specific needs and preferences. Both platforms offer valuable insights and data on cryptocurrencies but have key differences in features, user interface, and data accuracy. Here’s a comparison to help you decide:

Market Cap Calculations

One of the fundamental differences between CoinGecko and CoinMarketCap lies in how they calculate market capitalisation. CoinMarketCap utilises a “circulating supply” approach, considering only the number of coins currently in circulation and their market price.

Conversely, CoinGecko employs a “total supply” approach, which includes all coins ever created, even those not in circulation. This variance can lead to significant differences in reported market capitalisation figures, influencing investment decisions.

Range of Data

While both platforms offer a plethora of data on various cryptocurrencies, CoinGecko stands out for its more comprehensive range of information. In addition to standard metrics like crypto prices and market capitalisation, CoinGecko provides insights into developer activity, community growth, and liquidity. This comprehensive approach equips users with valuable data for analysing the crypto space and making informed decisions.

User Experience

User experience is another crucial factor when choosing a crypto tracker. Both CoinGecko and CoinMarketCap boast user-friendly interfaces with intuitive navigation. However, CoinMarketCap’s cluttered homepage and CoinGecko’s organised layout offer distinct experiences.

While CoinMarketCap may appeal to those seeking trending topics and short-form content, CoinGecko’s focus on clean design and customisable tabs caters to users prioritising ease of use and personalised portfolio tracking.

NFT Tracking

In the burgeoning NFT market, CoinGecko appears as the preferred platform for tracking non-fungible tokens. With comprehensive metrics on NFT volume transactions, unique NFTs, and upcoming events, CoinGecko provides invaluable insights into this rapidly evolving sector. In contrast, CoinMarketCap’s limited coverage of NFTs may leave enthusiasts seeking deeper insights feeling unsatisfied.

Pricing, Security, and Customer Support

When it comes to pricing, both CoinGecko and CoinMarketCap offer free and premium tiers with varying features. CoinGecko’s more affordable premium plans and extensive coverage of crypto assets, including NFTs and ICOs, make it an attractive option for cost-conscious investors.

However, CoinMarketCap’s flexible pricing tiers and robust security measures appeal to users with more extensive portfolios and enterprise-level needs.

Regarding customer support, both platforms provide FAQs, glossaries, and ticket systems for resolving queries. While CoinMarketCap’s extensive FAQ section and direct contact options cater to diverse user needs, CoinGecko’s encrypted data storage ensures heightened security for its users.

Conclusion: Choosing the Right Crypto Tracker

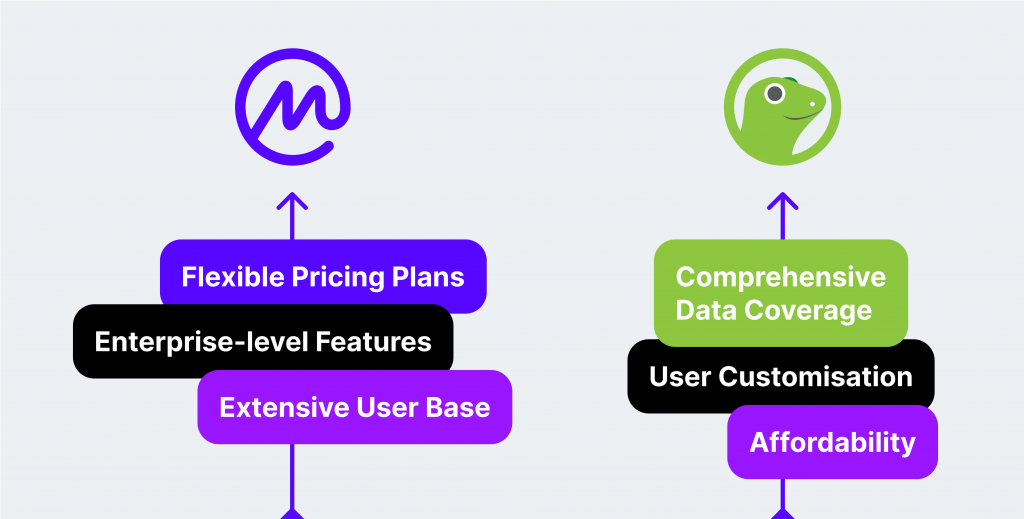

Ultimately, the choice between CoinGecko and CoinMarketCap depends on your specific requirements and preferences. If you prioritise comprehensive data coverage, user customisation, and affordability, CoinGecko emerges as the preferred option. However, if you value flexible pricing plans, enterprise-level features, and an extensive user base, CoinMarketCap may better suit your needs.