Solana Price Prediction – Why is SOL Going Up?

Amidst the shaken cryptocurrency market dynamics, altcoins are giving investors hope in some volatility that can yield some returns. While most of these fluctuations are downwards, SOL has recorded an upward movement in the last few days.

This trend comes with elevated on-chain activity and increased DeFi projects and memecoins on the Solana blockchain.

Will SOL continue its bullish rally? What’s the Solana price prediction for this year? Let’s analyze.

Is The Altcoin Season Over?

While some believe the altcoin season has lost steam, Solana’s performance suggests otherwise. Bitcoin dominance remains high, but other cryptocurrencies are setting their own trend.

According to CoinMarketCap’s altcoin season index, despite the score sitting at 15, the altcoin market capitalization has increased in the last few days. This uptick can set the foundation for a continued trend.

Solana’s activity is mostly attributed to rising DeFi projects and NFT transactions on its network. This surge outperforms that of the Ethereum blockchain, indicating that Solana is carving out its own path.

With the crypto market transitioning into a new phase under the new SEC leadership, investors are watching closely to see whether Solana continues its upward trend.

Solana Price Prediction 2025

With the rising hopes of Solana ETF approval this year, analysts and traders are bullish on the coin’s long-term potential. If the network maintains its technological edge and adoption continues, several predict that SOL will rise between $250 and $350 in 2025.

This Solana crypto price prediction relies on continued innovation and scaling solutions to be deployed by the network’s developers. Additionally, increased institutional interest in Solana-based projects could boost demand.

On the other hand, there is a growing concern that the trend might actually be over, and Solana may be heading to another winter, as The Coin Republic Solana price prediction suggested.

On-Chain Data

Network tracking offers valuable insights into Solana’s recent surge. As reported by Mitrade and CoinMarketCap, the number of active addresses and daily transactions on the Solana network has increased sharply over the past week.

This uptick accompanies a rising Total Value Locked (TVL) in Solana-based DeFi protocols, hinting at growing user confidence. Moreover, whale accumulation patterns suggest that large investors are showing great interest ahead of a further bullish rally.

These patterns align with bullish expectations, which place Solana price prediction in 2030 to the $500–$750 range if network growth continues at its current pace.

Solana Price Prediction

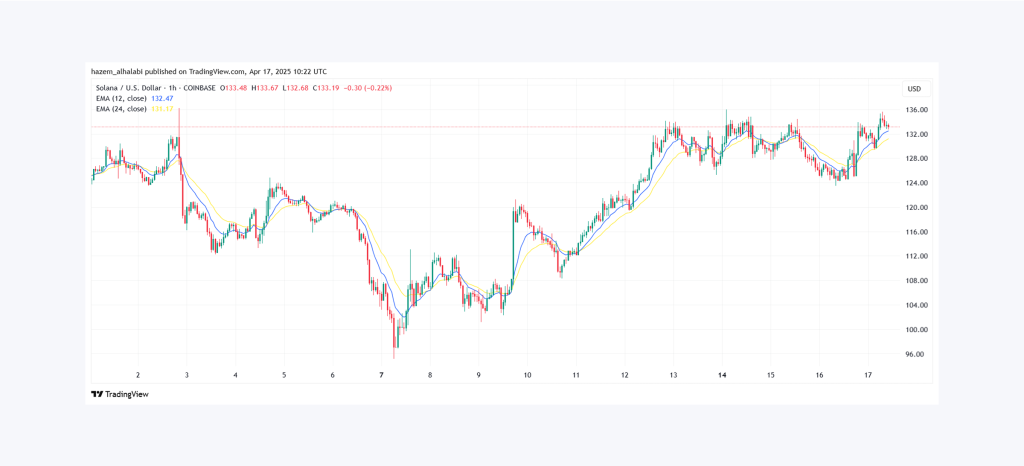

Let’s take a closer look at Solana’s market price and analyze its short-term and long-term trajectories using the exponential moving average indicator.

In the short-term analysis, we use 12-day and 24-day EMA lines highlighted in blue and yellow, respectively. We see that both lines crossed over and under the market price multiple times in April.

However, the recent price change started on April 16th, when the short-term EMA line (in blue) crossed the long-term EMA line (in yellow) and moved upwards. This trajectory picked up the market price and is expected to carry it for the next few days.

In the long-term analysis, we use 50-day and 100-day EMA lines. We see that both lines have been moving well over the market price since February. However, by the middle of April, the SOL and short-term EMA lines became closer as bulls picked up the coin’s price.

However, the crossover of the short-term line under the long-term line and heading down towards the price line suggests that the market might be set for another setback.

Final Takeaways

Solana’s recent momentum reflects both market recovery and strong network fundamentals. SOL remains a key altcoin to watch amidst the rising on-chain activity and bullish long-term outlook.

Optimistic Solana price predictions tell us the coin may reach the $200 mark this year. However, technical indicators show a downward-looking trend for the foreseeable future.

Disclaimer: This article is for informational purposes only. It is not financial advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.