Top Crypto Liquidity Providers to Work with in 2024

The rise in the crypto market’s popularity and the expansion of global markets have led to a significant demand for liquid funds that can help maintain stability in the buying and selling of investment tools. As a result, there has been a substantial increase in the demand for crypto liquidity providers, who offer various services aimed at ensuring an even distribution of liquidity between markets.

This article will tell you what crypto liquidity providers are, their functions, and what types they are divided into. You will also learn which institutional crypto liquidity providers are the best on the market today.

Key Takeaways

- Crypto liquidity providers offer a wide range of services related to the supply, processing, storage, and distribution of crypto asset liquidity.

- Institutional players account for a large share of the total number of all crypto liquidity providers in the market.

- The main objective of crypto liquidity providers, among other things, is to stabilize the value of assets at a given point in time.

What is a Crypto Liquidity Provider?

A crypto liquidity provider is a vital participant in the cryptocurrency market, either as an individual or an entity, that contributes to the overall liquidity by ensuring readily available buy and sell orders across a range of price levels for digital assets. These providers play a crucial role in ensuring the efficient functioning of crypto exchanges and trading platforms, contributing to a smooth and effective market operation.

By offering a continuous stream of buy and sell orders, crypto liquidity providers help prevent large price swings and ensure that traders can execute transactions promptly without significant price slippage. This stability in pricing and asset availability is crucial for attracting more participants to the market and fostering a healthy trading ecosystem where investors can confidently buy and sell digital assets.

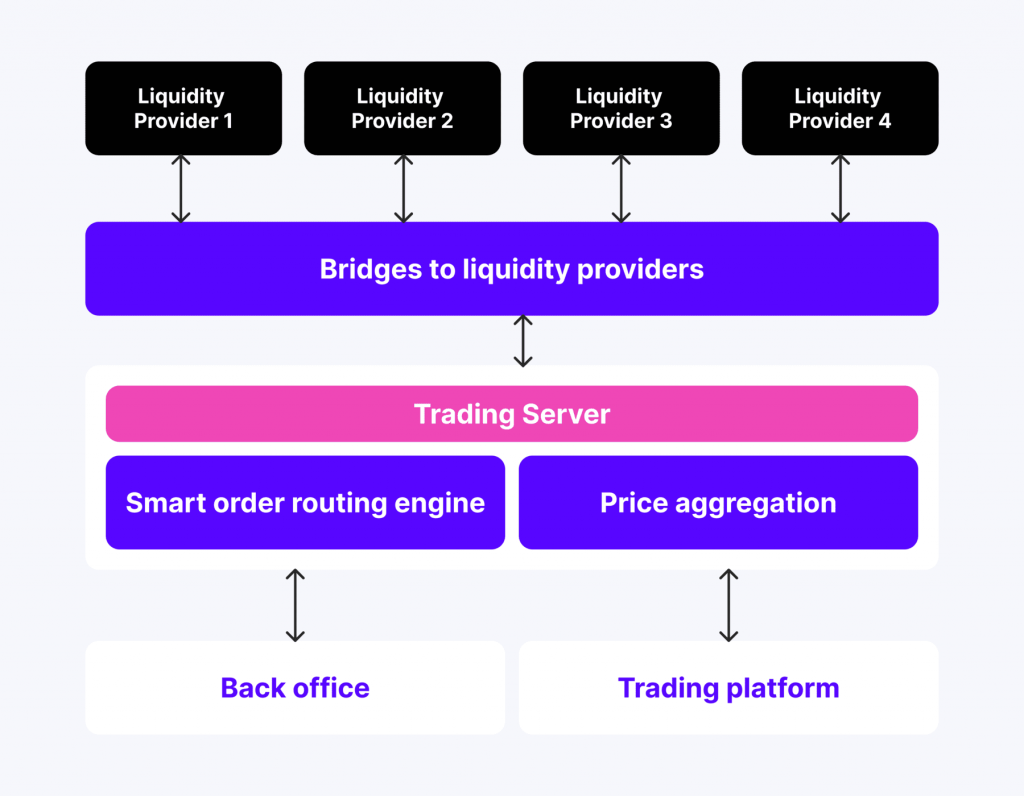

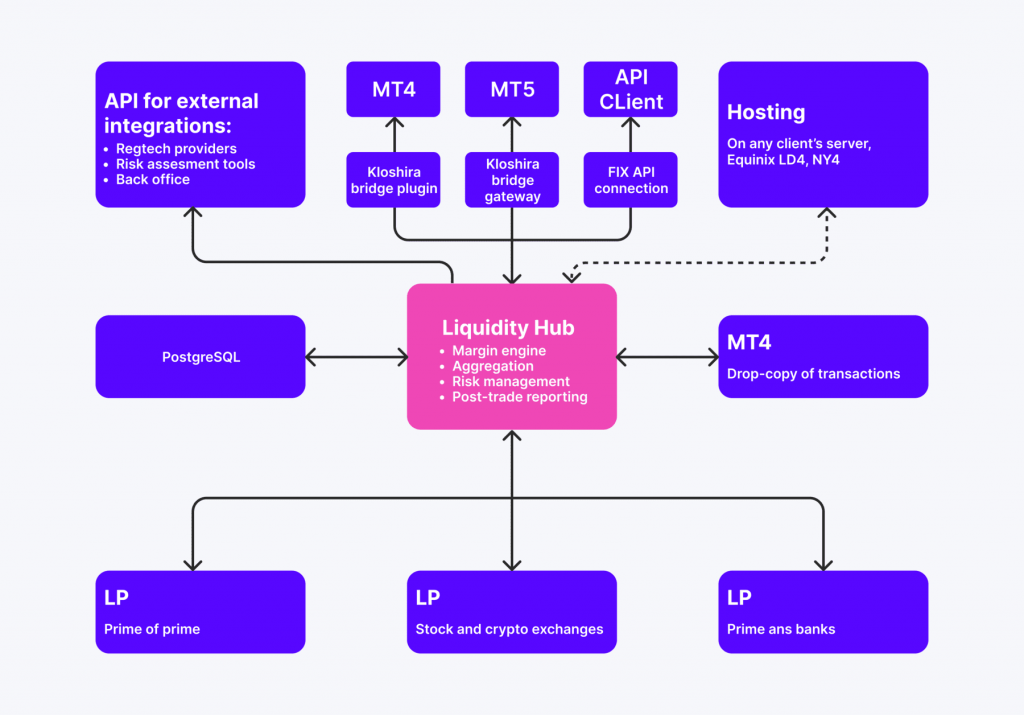

Crypto liquidity providers operate on the same aggregation and distribution model as liquidity providers for other markets, but their infrastructure for redistributing liquidity between assets is different due to the presence of deep liquidity pools where secondary and subsequent accumulation of crypto liquidity takes place for further distribution to assets with low levels of liquidity.

Key Functions of a Crypto Liquidity Provider

Crypto liquidity providers are primarily multifunctional services that offer a wide range of services related to aggregation, distribution, and delivery of liquidity in crypto to those assets where there is a shortage of trading volumes and low investment activity. Therefore, such services have special characteristics that determine their specificity of work. Such characteristics include the following:

1. Continuous Liquidity Provision

Liquidity providers in the crypto market serve a vital role in maintaining a consistent supply of buy and sell orders for a wide range of cryptocurrency pairs. By continuously offering to buy and sell assets, these providers ensure that there are always active participants in the market, thereby facilitating smooth and uninterrupted trading activities. Their presence helps minimize the risk of liquidity gaps and slippage and assures that willing buyers and sellers are always available.

2. Price Discovery and Price Stabilization

Liquidity providers play a crucial role in facilitating the smooth functioning of financial markets. By constantly offering competitive buy and sell quotes based on up-to-date market data, they contribute significantly to the accurate determination of asset prices. Their continual presence in the market helps stabilize prices, minimize extreme fluctuations, and create an environment of greater predictability and efficiency. This, in turn, fosters a more orderly and stable marketplace, benefitting all market participants.

3. Efficient Order Execution

Providers of crypto liquidity specialize in executing orders at high speeds, aiming to process trades swiftly and at the most favorable prices possible. They leverage cutting-edge trading technology and sophisticated algorithms to enhance order routing and execution, thereby reducing slippage and enhancing the overall trading process for users.

4. Market Making

Liquidity providers play an important function in financial markets by acting as market makers. They engage in continuous buying and selling of assets, offering narrow spreads between their buy and sell prices. This market-making activity is essential for keeping the market deep and liquid, ensuring that there are ample opportunities for executing large-volume trades with minimal impact on prices.

5. Customized Liquidity Solutions

Liquidity providers in the crypto space create customized crypto liquidity solutions designed to fulfill the distinct requirements of cryptocurrency exchanges, institutional investors, and other market participants. Tailored crypto liquidity pools, API integrations, and specialized services are among the offerings that can be provided to meet the unique needs of their clients.

6. Risk Management

Reputable cryptocurrency liquidity providers prioritize implementing thorough risk management frameworks to safeguard against potential risks and uncertainties while also upholding adherence to regulatory standards to ensure the integrity and stability of the market.

Their services often encompass comprehensive anti-money laundering (AML) and know-your-customer (KYC) compliance measures designed to support and enhance their clients’ overall regulatory compliance. By diligently adhering to these standards, liquidity providers play a crucial role in promoting a secure and transparent environment within the cryptocurrency market.

Fast Fact

Crypto liquidity is the most dynamic of all existing types due to the volatility of the assets for which it is designed to stabilize prices.

Types of Crypto Liquidity Providers

Today, liquidity is a crucial factor in maintaining the stability of the trading process on all types of markets, and the crypto market is no exception. Many mechanisms have been developed to ensure and maintain the efficiency of transaction execution. These mechanisms have found their expression in the features of special services engaged in the supply of liquidity, its accumulation, and other operations related to its use.

There are the following types of crypto liquidity providers:

1. Institutional Providers

Institutional providers are represented by hedge organizations, which are investment firms and financial entities with significant capital. They utilize advanced trading strategies to offer liquidity, often employing high-frequency trading (HFT) and algorithmic trading techniques. Their aim is to facilitate trading activities in the market.

On the other hand, in this group, there are proprietary trading firms that use their own capital to engage in trading and provide liquidity. These firms are known for employing cutting-edge trading technologies and sophisticated strategies to sustain liquidity across different financial markets.

2. Individual Traders

Individual traders can be categorized into two main types: professional and algorithmic.

Professional traders are experienced individuals using their funds and expertise to provide liquidity on different trading platforms. They often rely on their in-depth market knowledge and trading skills to execute trades and make profits in the financial markets.

On the other hand, algorithmic traders are individuals who utilize automated trading systems and algorithms to provide liquidity. They are proficient in developing and deploying trading bots to execute trades at high speeds. These traders leverage technology to analyze market conditions and execute trades based on pre-defined parameters to capitalize on short-term market opportunities.

3. Crypto Exchanges

Crypto exchanges serve as platforms for trading digital assets. There are two main types of crypto exchanges: Centralized exchanges (CEXs) and decentralized exchanges (DEXs).

Centralized Exchanges (CEXs) such as Binance, Coinbase, and Kraken operate by maintaining large order books and facilitating trades. These exchanges often have internal market-making teams to ensure enough liquidity for trading activities.

Decentralized Exchanges like Uniswap, SushiSwap, and Balancer operate differently by relying on user liquidity pools. These pools are essential for providing liquidity for trading on the platform, and users can contribute their digital assets to these pools in return for incentives.

4. Liquidity Pools and Automated Market Makers (AMMs)

Liquidity pools are essential components of decentralized exchanges (DEXs), where users contribute tokens to facilitate trading. These users, known as liquidity providers (LPs), earn fees from the trades within the pool.

On the other hand, automated market makers (AMMs), such as the ones used by Uniswap and SushiSwap, rely on algorithms to manage the liquidity pools and determine asset prices. These algorithms are designed to ensure continuous liquidity and efficient price discovery, thus enabling seamless trading experiences for users.

5. Broker-Dealers and OTC Desks

Broker-dealers play a crucial role in securities trading by acting on their client’s behalf. Cryptocurrency broker-dealers provide liquidity by executing large trades for institutional and retail clients.

OTC desks, on the other hand, are known for their discreet and professional facilitation of substantial trades. They specialize in providing liquidity for trades that, if executed on public exchanges, could cause significant price fluctuations. By serving as intermediaries between buyers and sellers, OTC desks ensure that large transactions are carried out smoothly and without any adverse impact on the market.

6. Crypto Funds and Market Makers

Cryptocurrency funds are investment vehicles specifically focused on cryptocurrencies. They serve as liquidity providers by actively participating in trading and market-making activities.

Market makers, whether independent firms or desks within larger financial institutions play a vital role in conveying liquidity by continuously offering to buy and sell cryptocurrency prices.

Top Crypto Liquidity Providers

Nowadays, the cryptocurrency market functions as a significant source of cash flow, facilitating trade through various intricate financial instruments. To maintain a steady and reliable cash flow, crypto brokerage firms and exchanges rely on crypto liquidity aggregators. Here are some of the top crypto liquidity providers worth considering for collaboration.

1. B2Broker

B2Broker Group stands out as a prominent PoP firm in the financial industry, recognized as one of the leading cryptocurrency liquidity providers globally. Serving as the official source of Forex, CFD, and crypto liquidity and technology for various entities, including brokers, crypto exchanges, hedge funds, and institutional clients, the company has firmly established itself as a key player in the market. Its primary focus is catering to the specific liquidity requirements of exchanges, brokerages, and startups, ensuring seamless operations within the cryptocurrency realm.

2. Leverate

Leverate specializes in providing unique investment technologies and crypto liquidity solutions tailored for brokers. Clients have access to premium services and cutting-edge technologies that effectively mitigate market risks. The broker offers a range of universal business solutions through LXSuite, professional support, and the innovative Sirix platform, ensuring its clients a comprehensive and efficient trading experience.

3. Vortex

Established in 2023, Vortex is an algorithmic market maker and token consultant. The firm earned the title of top market maker in 2023 due to its exceptional client retention rates. Setting itself apart from competitors, Vortex is a full-service token partner supporting listings, business growth, marketing, and fundraising.

Leveraging sophisticated liquidity provision algorithms, Vortex ensures a robust market presence 24/7, even during turbulent market conditions. With a focus on client satisfaction, the company’s trading team works diligently to meet the client’s specific price and profit objectives. Currently, Vortex boasts a team of 30 professionals and maintains offices in London, Dublin, Turkey, and the United States, with forthcoming plans to establish a presence in Hong Kong by 2024.

4. Kairon Labs

Established in late 2018, Kairon Labs is a distinguished market maker and advisory firm for digital assets and exchanges. Specializing in providing liquidity for crypto and FX markets, Kairon offers institutional-level solutions and quantitative trading strategies using proprietary software.

By tapping into its vast network of exchanges, investors, and service providers, Kairon Labs officially became a dedicated crypto-native algorithmic trading service in 2019. The company’s commitment to offering top-tier liquidity services to virtual asset issuers sets it apart in the industry, making it a trusted partner for those seeking reliable market-making and advisory services.

5. Interactive Brokers Crypto

IBKR Crypto represents Interactive Brokers’ innovative solution for trading cryptocurrencies at competitive rates. With transaction fees starting as low as 2%, users can trade and hold major digital currencies like Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

The platform not only allows users to hold US dollars in a cryptocurrency account and trade a variety of tokens offered by Paxos Trust Company but also provides a 24/7 cryptocurrency trading service. Paxos Trust Company oversees all digital asset trading and storage, ensuring a secure and reliable trading atmosphere. Moreover, Interactive Brokers’ platform provides a seamless trading experience, allowing customers to diversify their investments by trading cryptocurrencies alongside traditional assets such as stocks, options, and ETFs.

Conclusion

The smooth and efficient functioning of cryptocurrency markets largely depends on the essential role of crypto exchange liquidity providers. These providers play a critical role in maintaining market stability by facilitating order fulfillment, mitigating price volatility, enhancing the overall trading experience, enabling a wide range of trading strategies, effectively managing risks, and providing essential support to cryptocurrency exchanges. Their active involvement is vital for ensuring seamless and effective market operation.

FAQ

What is a crypto liquidity provider?

A crypto liquidity provider is an individual or entity that supplies the crypto market with liquidity. By ensuring there are a sufficient number of buy and sell orders at various price levels, they play a crucial role in maintaining market efficiency and reducing volatility, thereby enhancing the trading experience.

How do crypto liquidity providers work?

Liquidity providers work by continuously placing buy and sell orders for cryptocurrencies on trading platforms. They can operate manually or use automated trading systems to manage their orders. Their presence ensures traders execute their trades quickly and at fair prices, contributing to market health and efficiency.

How do centralized exchanges provide liquidity?

Centralized exchanges provide liquidity through large order books maintained by market makers and the exchange itself. They aggregate orders from a broad user base, ensuring enough buy and sell orders at various price levels to facilitate smooth trading.

How do decentralized exchanges (DEXs) provide liquidity?

DEXs provide liquidity through liquidity pools, where users deposit their tokens. AMMs manage these pools, using algorithms to set prices and facilitate trades. Users who contribute to the pools earn fees from trades within the pool.

Why is liquidity necessary in cryptocurrency trading?

Liquidity is crucial as it reduces volatility, enhances market efficiency, lowers transaction costs, and improves the trading experience.