Crypto Arbitrage – How to Capitalize on Crypto Market Imperfections?

The emergence of cryptocurrencies added a whole new market of money-making opportunities that many prefer over traditional stock exchanges. Bitcoin, Ethereum, Dogecoin, and thousands of other cryptocurrencies offer different chances of making profits.

One crucial lesson from the crypto market is its high volatility and dynamic nature, which is a key factor to consider when exploring arbitrage opportunities.

Crypto arbitrage is an advanced strategy that allows investors to capture quick gains by making rapid and timely decisions. What is crypto arbitrage, and how is it done? Let’s find out.

Key Takeaways:

- Crypto arbitrage is a trading strategy that uses market differences to seek marginal gains between buying and selling prices.

- Cross-platform and intra-platform are two ways to carry out crypto arbitrage trades.

- Arbitrageurs search for and buy a coin at a low price on a platform and then sell it at a high price in another market.

- The development of crypto arbitrage apps and bots made the process easier, saving time and offering higher returns.

What is Arbitrage Trading in Crypto

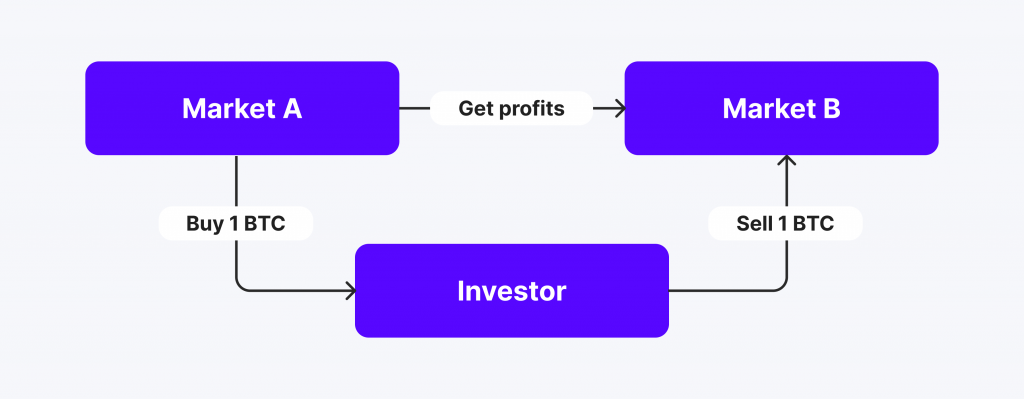

Arbitrage is a popular trading strategy where the investor takes advantage of market imperfections between multiple exchanges or regions and benefits from the fractional price differential.

Natural forces cause this slight discrepancy as distributed markets rebalance. This difference might be tiny, but repetitively executing large, similar orders accumulates considerable returns.

This divergence is exacerbated in more volatile markets, where the calibration process happens multiple times during the day because of massive demands and significant price fluctuations.

Crypto arbitrage takes place between different exchanges where virtual coins of various blockchains are bought and sold. The increasing number of decentralized and centralized exchanges and cryptocurrency brokers contributes to the spread of arbitrage in crypto.

How Crypto Arbitrage Works

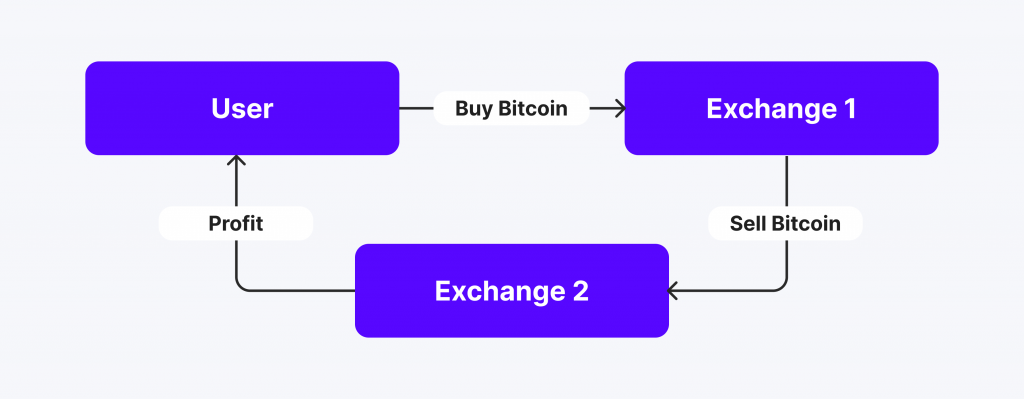

Cryptocurrency arbitrage involves finding a seller who offers cryptos at a lower price, buying the coin, and re-selling it at another exchange for a higher price.

Arbitrage in crypto exchanges happens because of the significant market volatility, the increasing market demand, and the enormous number of virtual coins, tokens, and DeFi assets. There are over 20,000 cryptocurrencies developed on multiple blockchains and ecosystems, which increases the number of possible arbitrage chances.

However, it is a complex approach that requires experience and skills to locate appropriate crypto arbitrage opportunities and execute orders at the right time. Therefore, most traders use bots and scanners.

Risk and Rewards of Arbitrage Trading in Crypto

Arbitrage strategy in cryptocurrency can be highly lucrative if implemented correctly. However, there are several reasons why only professional traders should follow this approach. Let’s review the pros and cons of cryptocurrency arbitrage.

Advantages

- Arbitrageurs can achieve quick returns by locating discrepancies and executing orders quickly.

- The vast number of crypto assets increased the chances of finding an arbitrage opportunity.

- The availability of crypto arbitrage bots and scanners lowered the barriers for new traders to engage in this strategy.

- Traders can conduct arbitrage crypto trading independently of other current market positions without affecting their balance.

Disadvantages

- The crypto market is highly volatile, and arbitrage opportunities can disappear within seconds.

- Most price discrepancies are tiny, and traders can only make considerable profits by trading a significant amount of assets minus the trading fees and taxes.

- Crypto arbitrage scanners can be technically inaccurate and mislead traders into unprofitable transactions.

- Locating market opportunities requires constant monitoring, which can be tiring and time-consuming.

Fast Fact:

Arbitrage bots are sophisticated programs written in Python to track discrepancies across exchanges and send the data to smart contracts for timely execution.

Types of Crypto Arbitrage

The decentralized ecosystem has grown, giving traders several ways to execute their arbitrage strategies. Let’s review the top crypto arbitrage trading strategies.

Cross-Exchange

Cross-exchange arbitrage trading entails finding price discrepancies between different exchange platforms, benefiting from the slightly different buying and selling prices of listed cryptocurrencies.

For example, exchange (A) might sell Monero at $160.20, while another exchange (B) might buy XMR at $160.30. This slight difference usually happens due to liquidity and demand recalibration at one of those exchanges, which traders can exploit to earn from this price difference.

Another cross-crypto-exchange arbitrage approach is to find two geographically dispersed platforms that use different currencies and locate a slight buy/sell price difference to conduct an arbitrage trade.

Intra-Exchange

Price divergence exploitation can take place on the same platform across different trading instruments of the same product. For example, the Bitcoin spot and futures contracts can be traded at different prices.

The spot markets represent the current BTC value and how much it costs to own the coin at the spot or the Bitcoin derivative contract. On the other hand, futures contracts contain the price that traders believe the asset will be worth at an agreed date in the future.

As the option’s expiration rate approaches, if the strike and spot prices diverge broadly, traders can take advantage of these differences to carry out arbitrage trading.

Triangular Arbitrage Crypto

The crypto triangular arbitrage uses three different cryptocurrencies. As such, instead of exchanging, for example, Tether to Ethereum, a trader can add Bitcoin as an intermediate and exchange USDT to BTC, BTC to ETH, and then ETH to USDT.

The slight price difference and mechanics between the three coins create an arbitrage opportunity. Arbitrageurs can make buy-buy-sell or buy-sell-sell approaches to locate profits between three different assets.

For example, a trader can do the following: use $30,000 USDT to buy BTC, acquiring 0.45714346 BTC. Subsequently, they use the acquired BTC to buy ETH, resulting in 8.65981059 ETH. The trader then sells the ETH for USDT, receiving 29,996 USDT in return.

In this scenario, the trader lost 4 USDT from this triangular transaction, which does not represent a winning triangular arbitrage. Therefore, traders must carefully analyze three coins to locate a positive outcome.

P2P Arbitrage in Crypto

Peer-to-peer networks allow market participants to exchange assets directly without trading them. Crypto P2P software facilitates coin ownership with minimum platform intervention.

However, some differences may arise between P2P rates and coin market value, which traders can use to execute arbitrage trades.

Is Crypto Arbitrage Profitable?

The profitability of crypto arbitrage strategies depends on multiple factors. Markets must have sufficient discrepancies to create enough buffer to buy the needed assets, exchange them on another platform, and realize gains before the market rebalances the gaps.

The foundation of crypto arbitrage finders and scanners made it more effortless to locate these opportunities. Some platforms provide arbitrage bots in crypto markets to search, analyze, and offer market entries.

Therefore, only experienced investors who acquire advanced trading toolkits, software, and significant capital can use this strategy to make considerable gains.

Conclusion

Crypto arbitrage requires significant research and analysis to find market discrepancies that can be exploited. This strategy entails buying one cryptocurrency from an exchange at a low price and selling it elsewhere at a higher price.

This price difference happens due to natural market dynamics, as different exchange software has distinct demands, liquidity, and participants. This leads to tiny price differences that offer lucrative trading opportunities.

Despite the availability of crypto arbitrage trading bots and automated analysis tools, it is recommended that only seasoned traders with considerable budgets and experience follow this strategy.