Solana Price Prediction: SOL’s Market Cap Exceeds $50 Billion, Analysts Believe We’re Just Getting Started

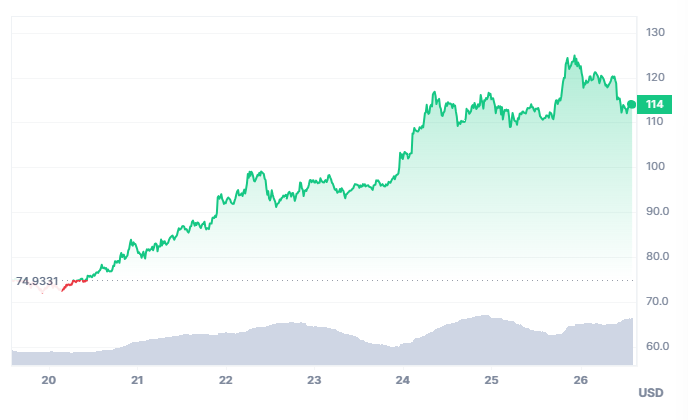

Solana’s (SOL) impressive growth continues as the asset recently reached a 21-month-high in terms of market capitalization. According to data from CoinMarketCap, SOL is up by 52.18% in the past seven days and is currently trading at $114.

This recent surge in price has boosted Solana’s total market cap to over $50 billion, with a brief peak of $53.4 billion on December 25th. The asset has also seen a significant increase in trading volume, which surpassed $6 billion in the past 24 hours, beating that of Bitcoin and Ethereum, the two biggest coins in the market.

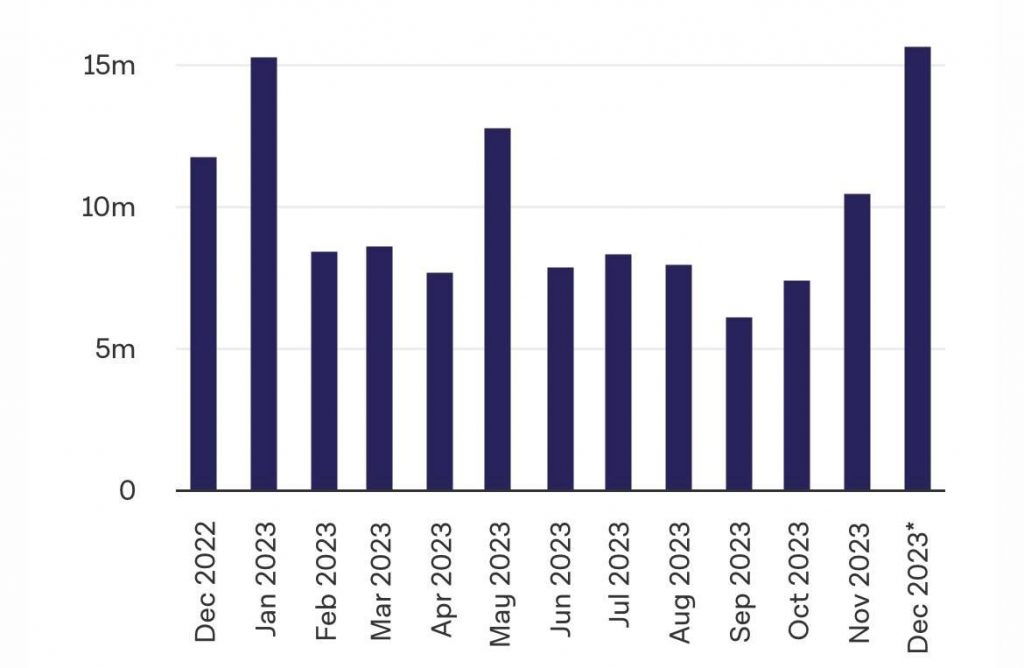

The Solana network has also set a new record for the number of new and active addresses in a month. In December, there were over 15.6 million active addresses on the network, marking a 50% increase compared to the previous month.

In terms of technical indicators, Solana’s Relative Strength Index (RSI) has also been on the rise following the recent price surge. According to Santiment, SOL’s RSI is currently at 87, suggesting a potential price decline as selling pressure may be triggered.

However, some analysts make a Solana price prediction: if SOL’s RSI remains below the 65 mark, it could indicate a possible continuation of the bullish momentum and lead to further price increases for the coin.

Why Is Solana Growing?

In an interview with BeInCrypto, Julian Deschler, the Co-founder of Elusiv, explained the factors fueling Solana’s impressive price growth this year.

According to Deschler, SOL’s technological capabilities are a major factor in its outperformance compared to other assets like ETH. With fast and cost-effective transactions, SOL eliminates the need for high gas fees in swaps or DeFi interactions, which makes it an attractive option for many users and developers.

The increasing number of projects launching tokens via airdrops on the network also assisted in boosting the asset price. This has drawn more attention to Solana and increased liquidity within the ecosystem.

While SOL’s growth may have initially been met with skepticism after the FTX collapse, it has persevered and continued to thrive. Deschler attributes this to its cost-effectiveness, which has played a crucial role in its success.

Deschler also believes that Solana’s growth is not just a short-term trend. Instead, it poses a serious challenge to the dominance of Ethereum and has the potential to attract even more developers and liquidity to the ecosystem.

Solana Price Prediction

With SOL’s impressive performance in the past year, many are wondering if the asset is nearing its peak. However, top crypto trader Bluntz Capital believes that calling a top for Solana’s native token makes little sense in the context of market cycles.

Despite rallying over 914% since the beginning of this year, SOL still trades approximately 113% below its all-time high of $260. In Bluntz’s view, coins that lead each bull run tend to exceed their old highs before the momentum wears off. Therefore, he expects SOL to continue steadily appreciating as adoption expands.

Rather than trying to time the market and identify swing highs, Bluntz advocates for a simple strategy of accumulating any notable dips. He believes that history remembers long-term investors, not traders who constantly try to predict short-term movements.

His ambitious Solana price prediction is that the asset will reach new all-time highs beyond $400.

Another Perspective

From a more technical perspective, Solana’s weekly time frame shows that the asset is currently in a strong bullish trend despite recent corrections. In June, SOL broke out from a long-term descending resistance trend line, and since then, it has only accelerated its upward movement.

However, according to technical analysts who employ the Elliott Wave theory, this strong rally may be nearing its peak. The most likely wave count suggests that SOL is approaching the top of a five-wave upward movement.

This convergence often marks a potential top for an asset, leading to a correction in price before continuing on its upward trend. In this case, SOL could experience a drop of tens of percent to its closest support level.

Despite this potential correction, analysts remain bullish on SOL’s long-term growth. According to this Solana price prediction, closing above the all-time high region could lead to a 45% increase in the asset.

Disclaimer: The information in this article is not meant to be investment advice. It is for educational and informational purposes only. Investing in crypto assets comes with a high level of risk, and individuals should always do their own research before making any investment decisions.