What are Blue-Chip NFTs, and How Do You Invest in Them?

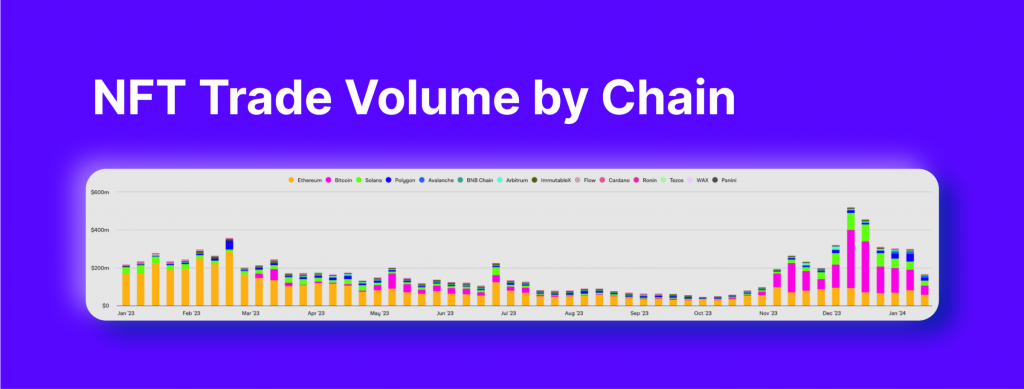

The NFT market reimagined digital assets: since their introduction, non-fungible tokens have gained widespread acceptance, and with a trading volume of $2 billion in February 2023, their demand keeps increasing.

However, a new player in the NFT space, blue-chip NFTs, inspired by traditional stock markets, is snapping on the heels of the original asset in popularity and demand. These NFTs are endorsed by celebrities and social media influencers, favouring them due to their high standard, value, and popularity.

In this article, we will discuss the phenomenon of blue-chip NFTs and their investment potential.

Key Takeaways

- NFTs are unique blockchain tokens representing digital and physical assets.

- Blue-chip NFTs are a high-value, low-risk digital asset originating from the stock market.

- You can find blue-chip NFTs on such popular marketplaces as OpenSea, Blur, and Rarible

- NFT blue chip is a profitable investment considered less risky than ordinary NFT.

What is a Blue Chip NFT?

Non-fungible tokens (NFTs) are unique, verifiable blockchain tokens representing digital and physical assets. The NFT market recorded over $56.5 billion in sales in 2022, with over 3 million unique buyers. Blue chip NFTs are emerging as a safer asset class than cryptocurrencies, according to a Q2 2022 report.

As we mentioned before, a blue-chip NFT is a high-value, low-risk digital asset originating from the stock market. These NFTs, which are considered leaders in their respective categories, have a track record of price stability and growth. They are backed by established corporations and are known for their stability, reliability, and consistent returns. Despite market downturns, these investments have a history of surviving.

The term “blue chip” originated from the stock market, referring to large market capitalisation stocks considered the backbone of the stock market. It is now used in various fields, including stocks, cryptocurrencies like Bitcoin and Ethereum, and professional sports leagues like the NFL and NBA.

In essence, Blue-chip NFTs are known for their intrinsic worth, safety, and historical appreciation, earning a niche in their segments and gaining acclaim among the digital collector community.

Moreover, Blue chip NFTs have performed exceptionally well despite market fluctuations, making them a significant asset class in the digital collector community.

As you can understand, they are industry leaders and are more likely to grow than other NFT projects. They are often seen on NFT sales leaderboards, have a popular brand, and have strong financial backing.

Fast Fact

In 2021, NFT was recognised as the word of the year by the Collins Dictionary.

Key Characteristics of Blue Chips NFTs

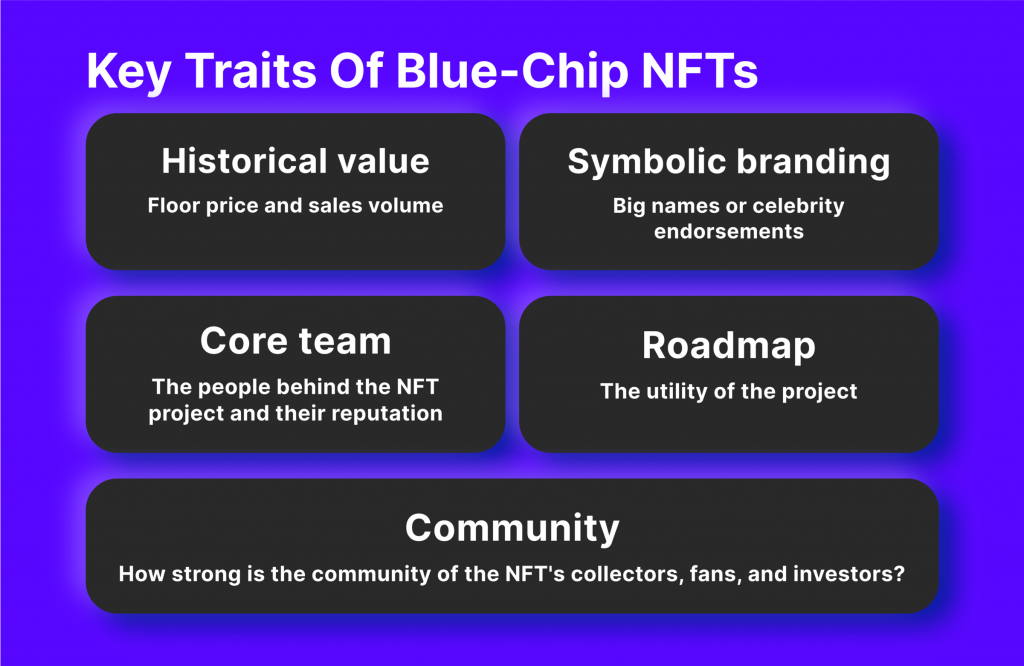

The selection of NFTs for blue-chip status is influenced by various factors, including the traits listed below. Although these traits may not necessarily indicate a blue chip project, spotting them in a blue chip is crucial.

Historical Value

An essential characteristic of top-tier NFTs is their historical value, which is identified through the floor price of the NFT and its sales volume. It must demonstrate a consistent value appreciation to be recognised as a premier digital asset. Simultaneously, its transaction metrics should reveal strong demand, often reflected in a noteworthy market capitalisation.

Symbolic Branding

Another trait of blue chip NFTs is brand strength. Typically, these digital assets are associated with famous personalities or are endorsed through celebrity endorsements. Assets associated with influential figures or icons are often held in higher esteem, attracting more potential enthusiasts and buyers.

For example, an NFT from a series whose owners include a famous artist, musician, or fantasy character like Harry Potter or Fantastic Beasts is more likely to be considered a blue chip NFT than one owned by an ordinary person. The association with a big name adds prestige and legitimacy to the NFT, attracting more buyers and investors.

Core Team

The team behind an NFT project plays a crucial role in shaping its reputation and determining its status. The people behind a blue-chip NFT generally have an untarnished reputation and a proven track record. This ensures that the non-fungible token is led by individuals capable of guiding it to success.

Roadmap

The roadmap of a blue chip NFT is another essential trait that distinguishes top-tier NFTs. It should embody artistic value and unlock practical benefits such as exclusive content access, entry to privileged events, or an opportunity to join niche groups. A well-defined roadmap illustrating the NFT’s potential and envisioned accomplishments enhances its appeal.

Community

The NFT community is a crucial trait in determining its top-tier status. A strong, proactive community of enthusiasts, patrons, and investors elevates its standing and helps drive its growth. Acting as an advocate, this community extends the blue-chip NFT’s influence and ensures its success.

How Do You Find a Blue Chip NFT?

To discover new blue-chip NFTs, it’s essential to consider broader market interests and dynamics. Projects with high transactional volumes and stable floor prices will more likely maintain their value over time.

To invest in blue-chip NFTs, start by researching established platforms like OpenSea, Rarible, SuperRare, and NBA Top Shot, which host a variety of NFTs created by famous artists, celebrities, and brands.

Stay updated with the NFT market by following influencers, collectors, and specialists and joining NFT communities, forums, and social media accounts. Focus on rare, limited-edition, or culturally significant NFTs, examining their reputation and performance before evaluating their value. Remember that the NFT market is dynamic, and what constitutes a blue-chip NFT may change over time.

Engaging with NFT communities and influencers can provide insights and exclusive chances. Participating in NFT auctions and drops can help obtain blue-chip NFTs upon their original release or by bidding.

The above-mentioned methods can help identify and acquire potentially lucrative NFTs. Understanding these assets’ reputation and past performance can help assess their potential blue-chip value, and analysing historical data helps make informed decisions based on the track record, rarity, and potential value appreciation of specific NFT collections.

Where Can I Buy Blue-Chip NFTs?

The top blue-chip NFT marketplaces include OpenSea, Blur, and Rarible.

OpenSea was founded in 2017; it is the largest NFT platform, with over 2 million collections and over $20 billion in transaction volume. OpenSea is backed by top firms like Y Combinator, Coinbase, Trust Wallet, Blockchain Capital, and industry leaders like Mark Cuban, Tim Ferris, and Ben Silberman.

Blur, an NFT marketplace with over 145,000 users, has transacted collectables worth over $1.4 billion and developed an aggregator allowing users to buy numerous NFTs from different marketplaces. It also has detailed charts and data to shortlist the best blue chip NFTs, such as Azuki, CloneX, and Bored Ape Yacht Club.

Rarible, built on the Ethereum blockchain, helps find and invest in blue chip NFTs by sorting collections based on rarity, price, and transaction volume. Founded by crypto entrepreneurs Alexei Falin and Alexander Salnikov in 2019, Rarible supports other blockchains like Polygon, Tezos, and Immutable X.

Also, most blue chip NFTs have passed their pre-sale stage, and subsequent sales are considered resales or auctions.

Why Should You Invest in Blue Chip NFTs?

NFTs have gained popularity due to their unique nature, which makes them more valuable than traditional digital assets like cryptocurrencies. They offer a new investment opportunity for collectors and investors and are often associated with famous brands or artists, further increasing their collectability.

Most NFTs in the marketplace are not worth investing in, but blue-chip NFTs offer significant features that make them worthwhile.

High Liquidity

Blue chip NFTs provide high liquidity, allowing buyers and sellers to acquire or sell them quickly. Liquidity is crucial when choosing crypto assets, as illiquid NFTs may be difficult to sell when needed.

Proven History

Blue chip NFTs have a strong track record in the NFT space, with increasing token sales value over time. The exponential growth of NFT holders leads to a surge in demand and price of blue chip NFT collections.

Low Risk

Blue chip NFTs are less risky and stable in price compared to normal NFTs, making them a better investment choice. They also maintain constant prices during normal market conditions, unlike the unpredictable fluctuations of normal NFTs.

Asset Diversification

Diversification is a crucial investment strategy, encompassing stocks and cryptos. It involves investing in diverse assets, such as adding NFTs to your crypto portfolio to avoid potential asset failures.

Community Participation

Blue chip NFT collectors often access exclusive community groups, allowing interaction with other NFT holders, discussing future trading plans, and receiving free airdrops, live stream access, and participation in crucial decision-making around the project’s ecosystem.

How to Invest in Blue Chip NFTs

Follow these simple steps to invest in blue chip NFTs successfully and gain significant profit from your investments.

1. To effectively invest in NFTs, it’s crucial to understand their basics and stay updated on news and trends. Also, it is essential to thoroughly research the NFT marketplace, including past performance and listing history of blue-chip NFTs.

2. Set a budget that suits your financial comfort level for NFT investments, ensuring you don’t overextend your funds.

3. Choose crypto wallets with NFT support to store your assets. The most popular wallets are Trust Wallet, Zengo, and MetaMask. Conduct a thorough research of wallets as not all support NFT storage.

4. Create a checklist of features you would like to have in your NFT. These might be price range, artistic value, category, and other unique features.

5. Select a blue-chip NFT that meets your needs and preferences, and buy it. Store your NFTs in a secure wallet (for example, a hardware wallet).

6. Purchasing NFTs allows you to become a member of a specific NFT community, enjoy various benefits, and join their official social media groups.

7. Staying updated on NFT-related events and trends is crucial for staying informed and ahead of the curve.

Are Blue Chips Safe?

Blue-chip NFTs are a stable and attractive investment due to their scarcity and market demand. Still, they also carry risks such as market volatility, potential fraudulent projects, and violations of intellectual property laws. These NFTs may involve digital assets based on copyrighted or trademarked material, possibly leading to infringement and legal repercussions.

Generally, the team behind these projects has a solid presence, the tokens have a clear use case beyond speculation, and the community is passionate about them. These blue-chip NFT opportunities are ideal for investors seeking stable investments.

However, it’s important to remember that a blue chip isn’t a guaranteed investment, and while some people consider blue-chip stocks to be safe, there have been instances where they have failed. Blue chip tokens have a similar profile to blue chip stocks but have a shorter track record and are more volatile.

As a result, they present a larger risk than blue chip stocks. The best blue chip stocks are stable companies with decades of experience, while some blue chip NFTs launched as recently as 2021 and bear a higher risk of failure. The NFT market is also more volatile than the stock market, making the NFT blue chip a more volatile investment.

The legislative environment governing NFTs is underdeveloped, causing ambiguities over their handling and adherence to current rules. Conduct thorough research before purchasing a blue-chip NFT to reduce these risks and stay updated with market movements. Also, diversify your portfolio by adding various assets to mitigate possible risks.

The NFT market is still developing, making it challenging to forecast the long-term performance of these assets.

To minimise risks, staying up-to-date with relevant laws and regulations is essential.

Top 3 Blue Chip NFT Projects

Blue-chip NFT collections are renowned for their high trading volumes, strong brand reputation, and strong community backing. Here are the three most notable examples of blue-chip NFT collections.

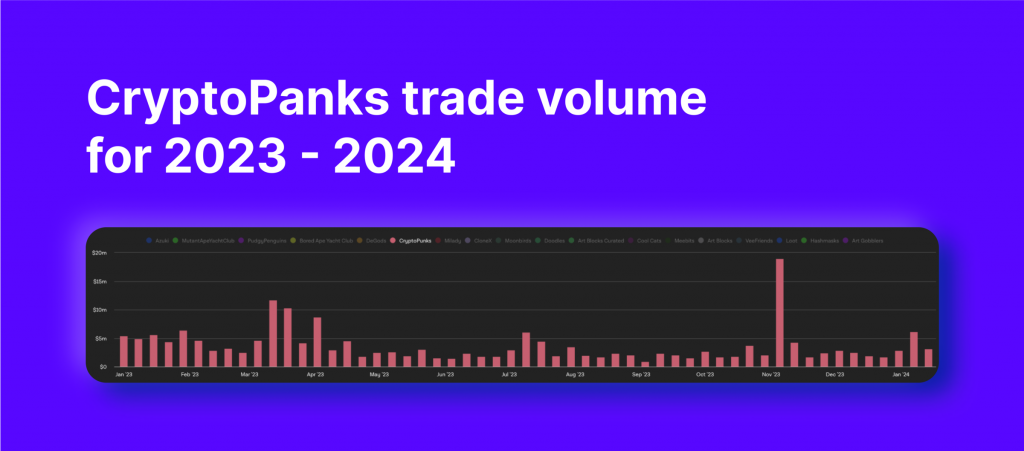

CryptoPunks

CryptoPunks is a collection of 10,000 distinct pixel art characters, each encapsulated as an NFT on the Ethereum blockchain. The images are inspired by the London punk scene and developed by Larva Labs in 2017. Owning this collection grants exclusive rights to a unique pixel avatar. CryptoPunks’ sales volume increased significantly in 2022 and 2021, reaching 575.2M in 2022, making up a 3% market share of NFT marketplaces.

It is one of the best-selling collections, with some even auctioned by Christie’s and Sotheby’s. Despite being costly, CryptoPunks NFTs have a more established track record than other blue chips, ranking among the top collections by sales volume.

The collection has a strong online community, with nearly 300K followers on its official X account. Celebrities like Serena Williams, Jay-Z, and Gary Vee own Punks NFTs.

Bored Ape Yacht Club (BAYC)

BAYC is a custom-made collection of 10,000 Bored Ape NFTs minted by Yuga Labs on the Ethereum blockchain in 2021. The blue-chip NFT, priced at an average of $45,800, gained popularity through celebrity endorsements. It allows collectors to create artworks of disinterested apes with randomly generated traits and decorations.

The unique characters distinguish them from each other. Purchasing a BAYC NFT grants access to the club, a graffiti board, exclusive staking pools, and access to other NFTs in the BAYC ecosystem.

Originally priced at $0.08 ETH, they have become a hit with celebrities and are regularly sold for hundreds of thousands of dollars. In 2022, BAYC was the best-selling NFT collection, selling almost $1.57B in volume sales.

Yuga Labs, the company behind Bored Ape Yacht Club, has also released other successful NFT collections, including Mutant Ape Yacht Club.

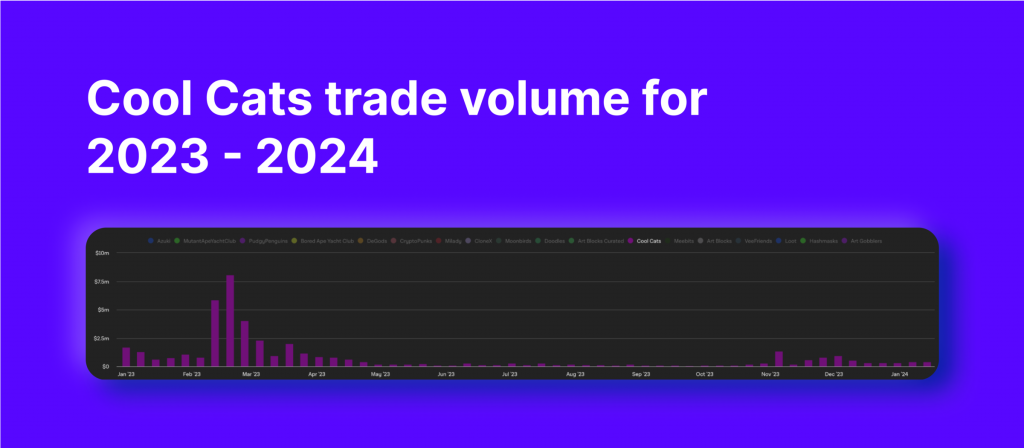

Cool Cats

Cool Cats is a collection of 9,999 randomly minted NFTs with unique characteristics, including bodies, faces, hair, hats, and clothing. Over 50% of Cool Cat NFTs have a basic status of ‘cool’, indicating their worth is 3-4 points. Launched in July 2021, Cool Cats gained popularity after boxing legend Mike Tyson endorsed the project.

The floor price of Cool Cats has dropped from 15.1 ETH to 2.6 ETH, but the team plans to introduce new engagement opportunities with Journeys, an interactive, gamified story-telling experience. Users will be rewarded with new character traits, trait rarities, and eligibility for rewards such as merch, IRL experiences, and NFTs.

Final Thoughts

Blue-chip NFT meaning for the crypto world is exceptional. These tokens are highly sought-after digital assets due to their historical value, brand power, practical utility, and strong community. These unique digital assets are valued for their rarity, collectibility, and access to exclusive communities and events.

Blue-chip NFT is considered a less risky investment than an ordinary NFT. Investors should consider blue chip projects with strong track records, high sales volume, and passionate communities, as they will continue to be among the most valuable and sought-after digital assets.

However, blue-chip NFTs still bear certain investment risks, and it’s crucial to investigate them thoroughly and stay updated on emerging trends and possibilities.

FAQs

What traits make a project blue-chip?

The term “blue chip” symbolises stocks from renowned organisations known for exceptional performance. Blue-chip NFTs are renowned for their intrinsic worth, safety, and historical appreciation.

What is an NFT collection?

A non-fungible token collection is a curated set of unique digital assets on a blockchain, each with its own intrinsic value based on rarity, ownership history, utility, and liquidity.

How to create an NFT?

You need a digital media file and a blockchain-compatible crypto wallet to create an NFT. Then, you should choose a marketplace, upload the file, mint it, and list it for sale.

Is creating NFTs expensive?

The cost of minting an NFT depends on the marketplace and blockchain used. Ethereum, the most popular blockchain for NFTs, typically incurs gas fees, listing fees, and commissions ranging from $0.01 to $1000.